By David Fyfe, Portfolio Manager

Critics often argue that New Zealand’s electricity system lacks sufficient investment in new generation capacity, contributing to price volatility and supply pressures. However, the numbers tell a different story. Over the past two decades, billions of dollars have been invested in renewables, even amidst significant market uncertainty. A recent report by Concept Consulting¹, highlights that the industry has developed approximately 1400 iMW of net new capacity since 1999—a 16% net increase in capacity despite major fossil fuel retirements, such as the upcoming (delayed²) closure of Contact Energy’s Taranaki Combined Cycle Plant.

Rational Investments Amid Uncertainty

The investment landscape for gentailers (generator-retailers) has been challenging, with uncertainties around factors such as the future of the Tiwai Point aluminium smelter, the Lake Onslow Battery Project, fluctuations in gas supply, emissions trading scheme policies, and transmission capacity concerns, just to name a few. Despite these hurdles, companies like Contact Energy, Meridian Energy, and Mercury have made bold moves, committing significant capital to renewable projects in the last few years. For instance:

- Contact Energy invested over $900 million in the Tauhara geothermal project, which will play a critical role in baseload generation.

- Meridian Energy has completed the high-capacity factor Harapaki wind farm project ($450 million), showcasing continued commitment to wind power.

- Mercury has added over $460 million in capacity through the Turitea wind farm as well as currently spending over $200 million adding a fifth generating unit at its Ngā Tamariki geothermal station.

These are really just the tip of the iceberg. There are many other ongoing projects from these providers and there is also Genesis, Manawa and several other operators and developers. Additionally, grid-scale battery projects are now part of the mix, with commitments from Meridian (100 MW at Ruakākā), Contact (100 MW at Glenbrook), and Genesis (100 MW at Huntly), all expected to be operational by 2027. While questions remain around the sustaining role thermal assets (especially the Rakine Units at Huntly) have in the future generation mix, the unavoidable message from the recent winter spikes has shown the ability to stockpile a fuel; be it gas, coal, batteries or water remains of utmost importance – with the right incentives to maintain these across the range of potential outcomes.

These sizable investments reflect progress in what appears a rational structure of New Zealand’s electricity market. Sustained wholesale electricity prices above the cost of new generation supply have signalled the need for new capacity, creating incentives for both established gentailers and new entrants to build renewable projects. The industry’s forward momentum underscores healthy competition in the development space, but meeting demand profiles under a market with more renewables needs to be closely monitored to make sure the lights stay on.

Are Supernormal Profits Really in Play?

Another piece of the puzzle is understanding returns and if there are excessive profits. If anything, the financials suggest that New Zealand’s electricity companies are walking a tightrope. Contact’s recent results showcased flat return on invested capital of around 4%³ - well below its cost of capital. Meridian’s similarly commented on its lower ROE/ROA historic metrics pointing to historically a more challenging environment than some headlines would lead you to believe. With billions invested in capacity-building projects over the past few years, these companies are reinvesting earnings rather than enjoying runaway margins. For investors, this highlights the complexity of managing returns while driving the energy transition. If anything, we should be questioning the ability to spend on new projects if the return on invested capital remains low relative to their cost of capital.

Reviews: Scrutinizing the Market

In response to past periods of market volatility and public concern, the Electricity Authority (EA) initiated a two-stage review⁴ into competition in the wholesale electricity market, focusing on the sustained high prices since 2018. The review aimed to assess whether the market structure supports effective competition and delivers fair outcomes for consumers as it transitions to a renewable-based system. This review was reported on in mid-2023, which while noting room for improvement did note “the electricity market has served consumers well, and competition is most likely to deliver the best outcomes for consumers” with “while fundamental structural reforms are not currently justified, some market settings will need to evolve to support the transition.”

More recently, the government has launched a broader review of the electricity market's performance, examining whether current regulations and market design support economic growth and provide reliable, affordable electricity. The terms of reference for this review were released, and signalled a comprehensive evaluation of the sector's health.

These reviews underscore the importance of transparency and accountability in the energy sector. They also highlight the need for a balanced approach that considers the interests of consumers, investors, and the environment. We look forward to the outcomes of the government review believing all critical markets like electricity need periodic reviews. Given the prior assessment work undertaken by the EA, we would be surprised to see any material changes from the current market structure but possibly updates for recent technological developments (biofuels etc).

The Energy Trilemma: Balancing Priorities

This recent volatility is a stark reminder of the energy trilemma—balancing security of supply, affordability, and sustainability. Striking this balance is no easy feat, particularly during a transition as complex as moving toward 100% renewables. While sustainability rightly takes centre stage, affordability and reliability must remain firmly in view. Overlooking any one of these pillars risks unintended consequences: higher emissions (as coal trucks roll into Huntly), unsustainable price spikes, or even blackouts. Navigating the trilemma requires not only innovative technology but also thoughtful, long-term policy and investment.

Unintended Consequences of Well-Intentioned Policies

As policymakers push for a greener energy future, it’s crucial to consider how well-intentioned initiatives can ripple through the system. The prior ban on new offshore oil and gas exploration, for example, aimed to curb emissions. This change happened to coincide with declining gas field reserves and left New Zealand more vulnerable to gas shortages than was expected by many. When hydro lakes ran low and the wind didn’t blow, the result was coal—hauled by truck from the Port of Auckland to Huntly Power Station every six minutes at its peak during the recent crisis. Well-crafted policies are not always easy to create and certainly not always popular, reminiscent back to the Think Big’ era of the 1980s some bold decisions were made – many unpopular but in hindsight, some like the Clyde Dam scheme are now vital national assets. Matching fuel sources, technology, reliability and affordability continue to be an active challenge.

The Geothermal Opportunity

Fortunately, the road ahead isn’t all coal trucks and price spikes. The government recently announced a $60 million investment⁵ to investigate geothermal energy’s potential to support New Zealand’s transition to greater renewable energy. This funding will enable detailed mapping of geothermal resources, exploring untapped areas that could bolster grid reliability without the emissions of thermal generation.

This move couldn’t come at a better time. Geothermal is uniquely suited to provide baseload power—unlike wind and solar, which depend on weather conditions. By leveraging our volcanic geology, New Zealand can continue to build a more resilient renewable system.

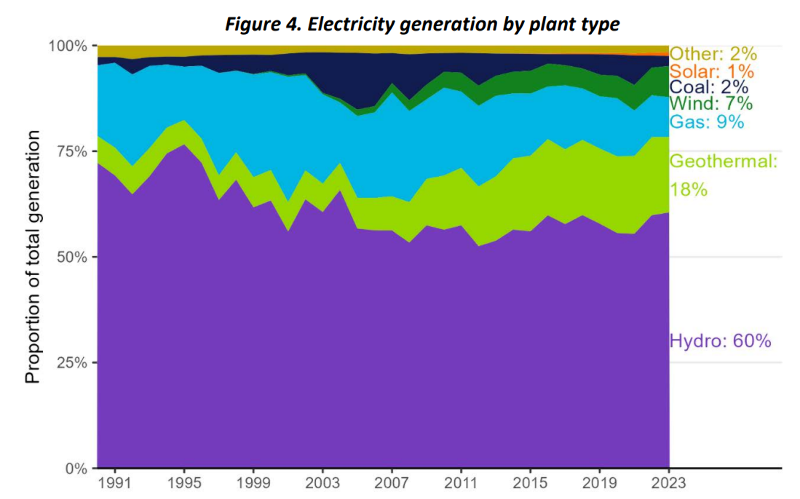

I recently met with Fervo Energy⁶ in the U.S., a company breaking new ground with enhanced geothermal technology. Their approach uses advanced drilling (ironically learnings from the oil & gas industry) and fibre-optic sensing to unlock geothermal potential in areas once considered inaccessible. Could similar innovations revolutionize New Zealand’s geothermal future? It’s an exciting question, one that aligns with projects like Contact Energy’s Te Mihi Stage 2⁷ project. Contact’s final investment decision to proceed with the $700m Te Mihi 2 continues their vote of confidence in geothermal, balancing a low carbon generation asset with stable base load electricity for the country – all at a reasonable (not excessive in our view) return for the development. My upcoming visit to their Taupo sites will offer valuable insights into how this resource can continue to anchor Aotearoa’s energy transition. Geothermal remains a relatively niche generation in a global context being less a mere 0.5%⁸ of renewable installed capacity, but within New Zealand generates close to 20%⁹ of our electricity capacity.

Source: MBIE – Energy in New Zealand 2024

Renewables: Not Just a Flick of the Switch

As an ESG-supportive manager, we’re all-in on renewables. But transitioning to 100% renewable energy isn’t just about building more wind farms or setting ambitious targets: it’s about thinking holistically. Industry collaboration and well-thought-out long-term strategy—one that balances renewable growth with system stability—will be critical to success and the continued ability to attract capital to the sector. The last 12 months has seen some impressive returns for the listed sector with utilities in the S&P/NZX50 up 18.3%¹⁰ ahead of the wider index. In a falling interest rate environment and with dividend yield growth expected across the sector, there are clearly some positive stories are still to be had.

The Road Ahead

New Zealand’s electricity market is navigating one of its most pivotal moments. Headlines about price spikes and competition concerns risk overshadowing the significant progress made by companies investing heavily in renewable infrastructure. The Concept Consulting report highlights that, even with uncertainties and market pressures, sustained investment continues to drive the system forward, with around 5000 GWh of new renewable generation set to come online in the coming years—enough to power 625,000 homes.

The energy trilemma reminds us that the journey to a renewable future must carefully balance sustainability, affordability, and reliability. By embracing innovation, pragmatic policymaking, and strategic investment, New Zealand can achieve a greener grid while ensuring a just and equitable transition.

Much like investing, the energy transition rewards those who embrace complexity, think long-term, and remain adaptable. Every great power surge begins with a spark of foresight—and perhaps, just a touch of geothermal heat.

References:

¹ https://www.concept.co.nz/uploads/1/2/8/3/128396759/20241104-genpipelinekeyevents.pdf

² https://contact.co.nz/-/media/contact/mediacentre/2024/contact-to-keep-tcc-available-in-2025.ashx?la=en

³ https://contact.co.nz/-/media/contact/pdfs/about-us/investor-centre/annual-and-half-year-reports/fy24-full-year-results-presentation.ashx?utm_source=chatgpt.com

⁴ https://www.ea.govt.nz/documents/3017/Decision_paper_promoting_competition_through_the_transition.pdf

⁵ https://www.beehive.govt.nz/release/government-exploring-new-energy-source

⁶ https://fervoenergy.com/

⁷ https://www.nzx.com/announcements/441782 - CEN-NZ Te Mihi 2/Wairakei announcement

⁸ https://www.irena.org/Publications/2023/Feb/Global-geothermal-market-and-technology-assessment

⁹ https://www.mbie.govt.nz/assets/energy-in-nz-2024.pdf

¹⁰18.3% return for the NZX50 Utilities sector for the 12 months to 31st October 2024.

Disclaimer: David Fyfe is a Portfolio Manager at Mint Asset Management Limited. The above article is intended to provide information and does not purport to give investment advice.

Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement here.

Comments

No comments yet.

Sign In to add your comment