Key market movements

- The MSCI All Country World Index (ACWI) increased 4.5% last month, in New Zealand dollar-unhedged terms. However, the strength was due entirely to NZD weakness with returns in NZD-hedged terms, coming in at -1.1% for October.

- Locally, New Zealand equity market returns picked up after a couple of flat months, with the S&P/NZX 50 Gross Index (including imputation credits) increasing 1.7%. The S&P/ASX 200 Index, however, pulled back 1.3% (-0.2% in NZD terms) after a strong September.

- Bond indices fell in October. The Bloomberg NZ Bond Composite 0+ Yr Index dropped 0.5%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) declined 1.5% over the month. US 10-year government bond yields were 50bps higher on the month, ending at 4.28%, whilst the New Zealand 10-year yield increased 24bps to end at 4.48%.

Key developments

After a fantastic period of economic outperformance, the US may finally be slowing. US data through October showed ongoing service sector strength and, along with Trump’s rising popularity, prompted the market to lift the implied trough in the Fed Funds rate from below 3% to around 3.5%. Real-time GDP measures, however, suggest a slowing in growth this quarter to around 2%, from almost 3% in Q3. This seemed to be reflected by the October labour market report where payroll growth came in weaker than expected and there were negative revisions for the previous two months.

The jury remains out on the extent of Chinese stimulus with further fiscal measures key to deliver a meaningful growth improvement. While the announcements of lower interest rates and easier borrowing requirements are necessary to engineer a pickup in growth, they are probably not sufficient to deliver something meaningful. This falls to fiscal policy, for which only CNY2trn of stimulus has been announced, c. 1.5% of GDP. The most optimistic expectations remain for as much as another CNY8trn of stimulus, which would likely lift 2025 GDP growth by around 1 percentage point to almost 6%. We think the market base case is around another CNY3trn of stimulus.

The Reserve Bank of New Zealand (RBNZ) accelerated its easing cycle in October, cutting the Official Cash Rate (OCR) by 50 basis points amid declining inflation and excess economic capacity, a widely anticipated move that led to only a mild market reaction. Inflation is now within the 1-3% target band, but core pressures still exceed the 2% target, leaving markets divided on whether a 50 or 75 basis point cut is more likely at the November policy meeting. Business optimism is rising rapidly, with October’s ANZ Business Outlook reaching its highest confidence levels since 2014, indicating the economy’s downturn may be easing. These improvements hint at a summer housing market boost and broader recovery by 2025, although the labour market is expected to loosen further, with unemployment likely peaking in early 2025.

What to watch

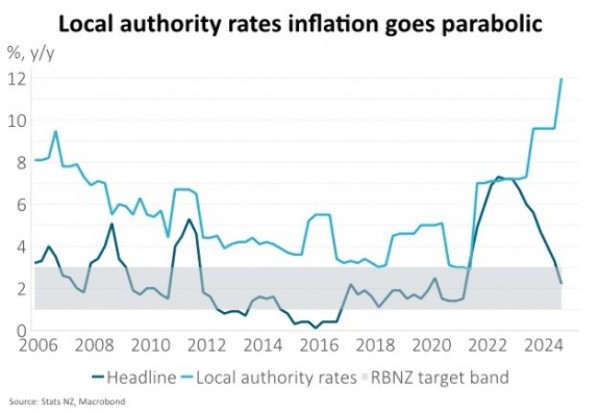

While NZ Q3 CPI data showed a return to the RBNZ’s target band for headline inflation, local authority rates have gone parabolic – up 12% over the past year and likely to do the same in the coming year. This creates a possible issue for the RBNZ. On the one hand, there is very little monetary policy can do to influence this type of inflation. On the other, higher local authority rates (along with rising insurance costs) are keeping non-tradable inflation too high. The situation, however, is likely more comfortable for the central bank given headline inflation and inflation expectations are close to the 2% target.

Councils undertake minimal borrowing in their own name, instead predominantly funding via the Local Government Funding Agency (LGFA). The LGFA’s AAA credit rating was recently reaffirmed with a stable outlook by Standard & Poor’s. Taken together, this suggests that, despite challenging borrowing needs, bond investors needn’t worry about the credit quality of the sector. Our team looks further out and is cautious that an increasing debt burden will make the NZ local government sector look more like an outlier globally, which could cause ratings agencies to reassess the very high ratings afforded to the sector.

Market outlook and positioning

The pending New Zealand company profit-reporting season for the September period may continue to see post-result reductions in earnings per share forecasts. October’s ‘less bad’ Annual Shareholder Meeting (ASM) season has got investors thinking about the potential for a turn to more positive earnings from the NZ share market. But company management and boards of directors are likely to continue to provide cautious outlook statements given economic activity continues to slow. While this earnings season may not yet provide a positive turning point for company guidance, downside risk may be limited given consensus market expectations are conservative and the trend of improving business confidence we are currently observing has historically been associated with a recovery in earnings forecasts across the New Zealand market.

Consensus earnings revisions for the broader Australian share market remained net negative (more downgrades than upgrades) over the October month with consensus market 12-month forward earnings per share revisions falling by-0.5%. The reduction was mainly driven by the energy (-2.5%), utilities (-1.4%) and materials (-1.4%) sectors. Information technology (+0.6%), communication (+0.4%) and property (+0.4%) saw earnings upgrades over the month. 12-month forward earnings per share revisions over the past three months for the Australian share market remained negative at -4.3%. Commodity prices, which have driven downgrades in energy and materials, have the potential to stabilise. Higher labour and regulation costs may remain a headwind for wider Australian market earnings forecasts.

While geopolitics have the potential to increase short-term capital market volatility, we continue to focus on macro-economic settings and earnings momentum. Earnings growth leads share markets. In the near-term investors need to be patient in navigating geopolitical volatility but our research continues to point to a recovery in local company earnings which may underpin share market returns.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Lower interest rates may support a further pick up in merger and acquisition (M&A) activity by providing greater funding certainty, but M&A activity only brings forward future value – it does not create value; long-term earnings growth creates value. Within the portfolio, we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, information technology, and materials sectors given they offer the potential for compound growth. We continue to have a bias to quality, well-capitalised businesses that are well-positioned to fund value-adding growth opportunities. The portfolio remains underweight in the lower growth utilities, telecommunications, infrastructure and real estate sectors.

In fixed interest portfolios, we recently noted that, with an aggressive rate cut cycle well priced into the market, our attention would shift elsewhere into aspects such as credit and security selection. However, duration is continuing to matter. Currently, with inflation looking to be yesterday’s problem, the market has adopted fiscal issues as its new bête noire. In New Zealand, with the supply of central and local government bonds both at record levels, one might have expected pressure on longer term yields. That has happened, with both markets weakening against swap rates, but it is also a market priced on relativities and NZ Government Stock has fared well, particularly vis-a-vis global bonds markets. With global yields low and with considerable rate cuts priced in, we had shifted to a short duration position last month. After a rise in global rates, we have now squared up the position. The sharp multi-year deterioration in the projected US debt position looks likely to remain an unresolved issue for some time. Overall, the market looks fairly priced, and we are inclined towards moderating risk positions for now. If volatility does increase, we prefer to be in the best possible position to take advantage of any opportunities.

Within the Active Growth Fund, we continue to hold a small underweight position to global equities. One of our reservations about taking a more constructive view on global equities is valuations. While not a short-term indicator, the level of risk premium that is priced into current valuations, measured by the forward-looking equity risk premium, is hovering near two-decade lows. This is largely driven by mega cap tech valuations in the US, whereas the median multiple is more reasonable. That being the case, we see some scope for broadening within the US equity market towards middle and smaller capitalisation companies which are more exposed to economic growth in the US and have valuation upside (small caps are trading at almost 20-year lows relative to large caps globally).

In the Income Fund, we currently hold a neutral 32% allocation in equities, balancing expensive global valuations with limited downside risks in the Australasian market. With inflation falling and rates being cut, we see a positive environment, bolstered by rising New Zealand business confidence. We prefer to wait for clarity from the US election before adjusting our equity allocation. In fixed income, we had reduced duration but reinvested as yields rose, keeping positions neutral. With New Zealand’s inflation at 2.2% and higher yields, there’s an increased risk premium, enhancing market appeal. Investment-grade debt remains a core holding.

Article by Hamish Pepper, Director, Fixed Income and Currency Strategist, from Harbour Asset Management Limited. This content is not intended as financial advice.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

Comments

No comments yet.

Sign In to add your comment