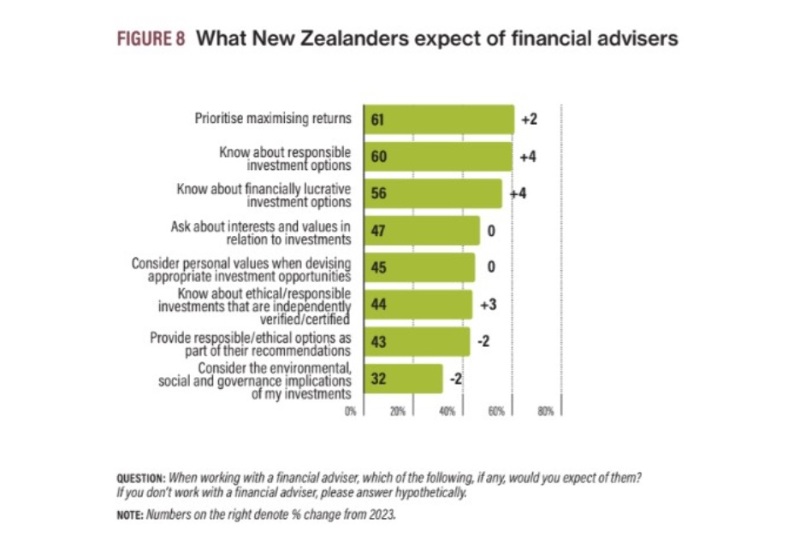

Meanwhile 56% of respondents to the annual survey on demand for ethical investing by RIAA (Responsible Investment Association Australasia) and Mindful Money expect advisers to be experts on lucrative financial options; a 4% increase. Those expecting their KiwiSaver and other investments to be managed ethically rose to 77%, up 3%.

The survey of one thousand New Zealanders; 28% Baby Boomers (over 59), 26% both Gen X (44-58) and Millennials (29-43 years) and 20% Gen Z (18 to 28), asked extra questions on financial advice and advisers. More than half (51%) of respondents have had financial advice, but only 10% regularly.

Reasons given were needing professional specialist advice (39%), getting a mortgage (24%), putting money aside for children or grandchildren (14%), a life-changing event (13%) and looking for ethical/sustainable options (12%).

Relatively few had obtained financial advice from a robo-advice service (6%) or said they would consider it in future (15%). Of the others, 31% hadn’t heard of robo-advice and 39% said they wouldn’t take it.

Interest in ethical investing was more heavily weighted towards women, younger respondents (Millennials and Gen Z) and those with university degrees.

Wealth transfer

RIAA co-CEO Dean Hegarty says the research findings are a call to action for financial advisers especially with the intergenerational wealth transfer between Baby Boomers and younger generations.

“More than half tell us they expect their adviser to be knowledgeable about sustainable products and that is only going to increase as that cohort of Millennials and Gen Z come through and begin to hold wealth. As an adviser, what are you doing to prepare?”

Hegarty says under regulation there is an expectation of a financial adviser to know their client.

“Three quarters of New Zealanders are saying they expect their funds to be ethically invested in a way that aligns to their values. Asking questions about those values is about how well you know about your client and how well you’re able to meet their investment goals and expectations.”

One finding that jumps out, says Hegarty, is the percentage of people (46% up 1% from last year) who believe ethical funds will outperform. While this increased from 40% to 45% in 2022, it was interesting to see continued growth despite 2023’s market volatility due to geopolitical events.

More than 57% of respondents would consider switching providers if their investments didn’t align with their values. This was more likely the case with younger investors, women, and investors with lower balances ($30-50,000). Switching was less likely with Baby Boomers.

Respondents concerned about greenwashing increased by 2% to just over half (51%).

More people say they would like to find an ethical fund in the next year (27%) than those who already have one (20%), and more would like to switch within the next five years (23%), while 59% are more likely to choose ethical and RI funds that have independent certification.

There is growing support for positive impact investment. 54% would invest in positive impact funds if the returns are comparable to investment benchmarks, while 20% would accept a lower return.