The stewardship reports of three signatories; Milford Asset Management, ANZ and Russell Investments, are provided as examples of investors stepping up their reporting activities.

ANZ’s Sewardship Update was cited for its “clear and succinct summary” of its proxy voting.

From Jul 1 to Dec 31, across 991 unique proposals available to vote, ANZ voted against management 64 times (6.5%).

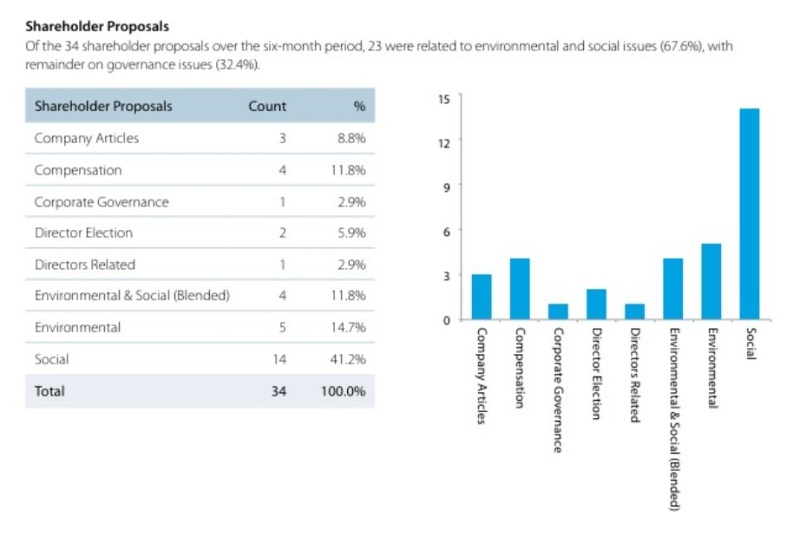

Of the 34 shareholder proposals over the six month period, 23 were related to environment and social issues (67.6%) with the rest being governance.

Russell Investments report is cited for sharing examples of how conflicts of interest can arise in its role as a ‘manager of managers’ and the control procedures it has.

One example is inappropriate selection of managers for commercial reasons such as appointing a money manager in return of AUM investment.It controls for this by selecting based on the ability of the money manager’s product to contribute to the fund’s/clients risk and return objective and overseen by the entity-level and global committees.

Corporate engagement

Milford Asset Management is cited for its broad and in depth reporting on key engagement activities going back to March 2022.

As an active manager Milford has a dedicated sustainable investment team researching best ESG practices. This helps it identify ESG risks and underpins its engagement with companies.

All companies Milford invests in are evaluated using an internally developed checklist. The checklist is the core of Milford’s sustainability process and engagement is its primary tool for action.

Milford says sustainable transition means change over time and accepts that it will require compromise.

Hence the engagement schedule includes gambling, alcohol and fossil fuel companies. Milford says companies are selected for engagement based on their ability to cause environmental and social harm, and the level of influence it holds as a fund manager due to the size of its holding.

Milford has engaged with ASX-listed Aristocrat Leisure on earlier identification and prevention of gambling harm, Fletcher Building on decarbonation and responsible sand mining, Ryman Healthcare on decarbonisation of new development, and Delegats on social harm caused by alcohol. Here, engagement was on Delegats developing low alcohol alternatives and participating in harm reduction programmes. In all cases listed re-engagement is on the cards with the exception of Fisher & Paykel Healthcare.

In this case Milford engaged with the manufacture of healthcare devices on modern slavery has been completed. Key issues were supply chain mapping to identify risk, and worker education, welfare and whistleblowing. Milford says FPH has made “significant progress in strengthening their human rights risk assessment and due diligence processes.”

Five Australian mining companies were the subject of engagements on the issue of emissions reduction and improved disclosure. For all there will be more engagement when they have sustainability strategies and improved disclosure.

A proactive example is meetings with Ryman Healthcare CEO and chair to encourage the company to set decarbonisation standards for new developments. The company recently announced a new sustainability strategy including science-based emissions targets.

A reactive engagement was with DGL Group after its CEO made offensive comments toward Nadia Lim. Milford met with the CEO and chair to say the comments cause harm, highlight the risk of poor culture and judgment in company decisions; and detail its expectations of remediating the matter. After a public apology, Milford remained concerned about DGL’s commitment to ESG principles including around governance structures and sold its position.

Positive step

There are now 20 signatories managing $174 billion in assets.

The Stewardship Code review says full stewardship reporting wasn’t expected in the first year, and while the reporting done didn’t meet the code’s complete reporting requirements, what has been done is a positive first step.

Several international signatories, including Russell Investments, First Sentier Investors, Nikko Asset Management and Northern Trust did release more extensive stewardship reporting.

Climate change was the most common engagement theme and modern slavery the most common social engagement theme.

There were strong levels of voting by investors at company meetings and signatories that reported on this voted at 95% or more meetings.

There were few reported examples of collaborative engagements in NZ, signatories tended to be members of the global collective engagement initiative, Climate Action 100+. Last year Responsible Investment Australasia reported that for the first time in NZ, corporate engagement and shareholder action was the most common responsible investment approach, overtaking negative screening.

Comments

No comments yet.

Sign In to add your comment