Earlier this year a pilot group of 2,500 Sharesies customers and staff began trialing the scheme which lets members invest in five base funds - three growth options from Pathfinder, Smartshares and PIE funds and balanced and conservative funds from Smartshares.

Portfolio displayed is a guide, not from a real customer. For informational purposes only

From the pilot group, Sharesies KiwiSaver now has $66 million in funds under management with an average age of 36 and an average balance of $27,000; around the same as the average balance across all providers.

In May Sharesies got regulatory approval to extend the scheme to allow members to invest up to half their KiwiSaver portfolio in individual company shares and ETFs, ranging from 0.1% to 5% per selection. This is the first time this self-select feature has been available.

Sharesies head of KiwiSaver Matt Macpherson says there are currently 93 NZX-listed options available including the most popular ETF on the Sharesies platform- Smartshares’ US 500.

He says US share markets will be added around mid-next year and the ASX after that. He thinks eventually there will be around 500 stocks and ETFs available for self-selection.

Investment builder tool

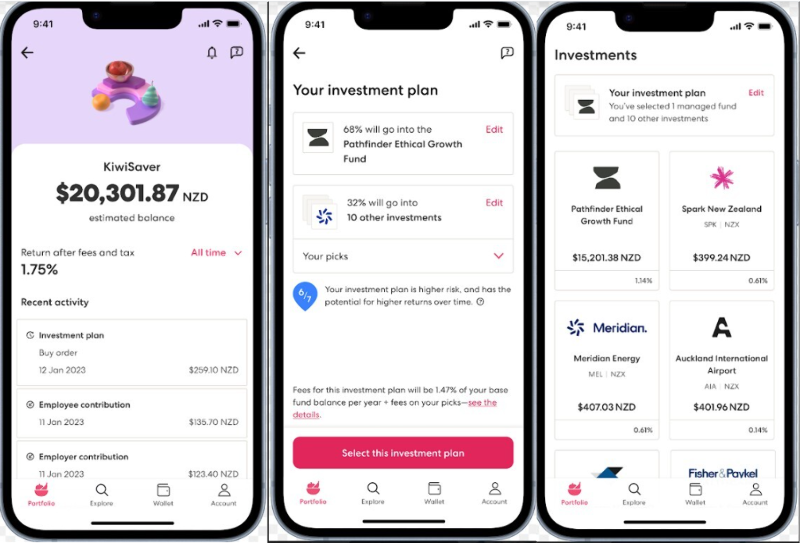

Sharesies used its own technology to the scheme including an investment builder tool on its website to guide prospective customers in self-select investment planning.

Once investments are selected, the tool calculates the plan’s risk from 1-7 (high risk) to show how much the combined value of the base fund and any shares and/or ETFs, might fluctuate, over time.

It also estimates fees the investor could expect to pay over the first year.

Members can change their investment plan whenever they like—such as when their risk profile, goals, or values change. Sharesies recalculates the risk level and even when customers don’t change their plan, Sharesies will update it each month using the latest data.

More education

Sharesies has ramped up the amount of education and information with information on performance and fees and education flows built into most web pages and the app’s screens.

Macpherson says feedback from the pilot has always been that customers wanted more information and control over how and where they invest.

“When we were doing our research before we got started on the build, a lot of people were telling us they wanted us to demystify certain aspects of the scheme or they wanted us to go into extra detail,” says Macpherson.

Before members reach the option to self-select they are put through more education including values, risk appetite, fund performance, how to diversify, the volatility profiles of companies versus bonds and a reminder about emotional and understanding emotional biases.

“And then finally if you’re not sure, there’s a message to seek financial advice.”

Sharesies is interested in eventually integrating licensed financial advice into its KiwiSaver scheme, says Macpherson.

“While not immediately, we see the value in having financial advisors being able to support our members."

Sharesies also launched its KiwiSaver-dedicated podcast The Payoff, with the sixth episode covering the Sharesies scheme.

Fees

The fee structure is based on each individual investment plan. Base funds have their own underlying fees, and Sharesies doesn’t charge additional management or administration fees. There are no performance fees or annual member charges and no management fee on self-selected shares and ETFs.

But there is an administration fee of 0.15%, and a transaction fee of 1% for self-select investments up to $1000, plus 0.1% for amounts over $1000 - which is aimed at people transferring in from other KiwiSaver providers.

The KiwiSaver scheme is wrapped in a PIE, regardless of whether it includes individual shares and/or ETFs or not.

Macpherson says Sharesies uses Apex to integrate its KiwiSaver scheme with the Inland Revenue Department and its five base fund providers.

Comments

No comments yet.

Sign In to add your comment