By Stephen Bennie

Right now, it’s likely that investment news channels are still talking about the US debt ceiling crisis. It makes for sensational headlines. What would happen if the US defaulted on its Treasury bonds? No one knows for sure because its never happened. But no comments I’ve read suggest it would be a positive event. Rather, the chatter is much more about what a catastrophe it would be, a veritable financial apocalypse. As media loves jamming bad news our way, the scarier the better, the US debt ceiling is getting a lot of attention. So, I thought it might be useful to take a step back and go through what is the debt ceiling and how does it actually work.

The first requirement of a debt ceiling is to have debt. The US has debt because most years its Federal Government’s spending exceeds its revenue. Since its inception the US has needed to borrow, at the end of the American Revolutionary War in 1791 it had outstanding debt of 75m¹. At that time the debt was mainly owed to France who were well into their Second Hundred Years’ War with Britain and were more than happy to help fund an enemy of their enemy. Incidentally that relationship was instrumental in the French sending the Statue of Liberty to New York as a symbol of their important relationship.

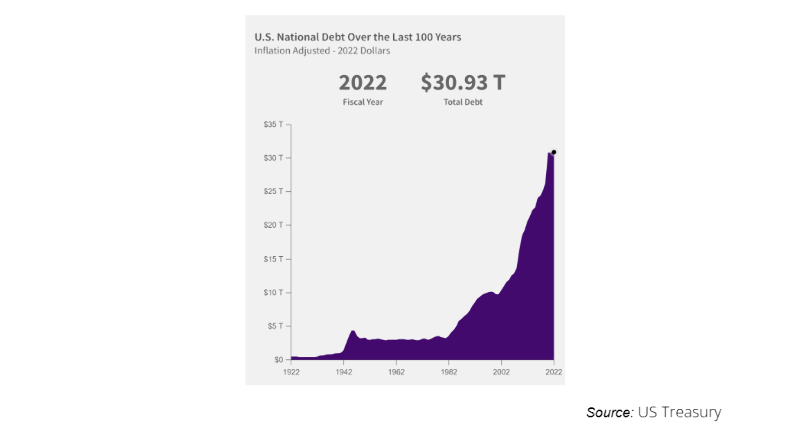

Since those times the US debt has increased, and they borrow from a much wider set of countries and institutions. In fact, it borrows a very large amount of money, US national debt currently sits at $31.45 trillion². The chart below shows the incredible growth in US debt levels over the past 100 years. It’s not often you see a debt level chart that makes Ryman Healthcare look like cautious managers of debt. The mind-blowing part of the chart below is that it is inflation adjusted.

Inflation adjusted US national debt levels to the end of 2022

In simplistic terms, the US requires external funding because the income and social security taxes, which form the bulk of its annual revenue, are not enough to cover its annual outgoings. The largest of those outgoings being social security, health, income security, Medicare, and the military. You’ll doubtless recall the significant boost that the US Federal Government provided its citizens in response to the pandemic related lock downs of 2020. That spending quickly added the thick end of another $5 trillion to its national debt.

Okay, so we have plenty of debt. The next part of the story is the ceiling and how that works. To be frank, the chart above does little to suggest the existence of any ceiling, or at least not one that is ever reached. But there is one, Congress voted to raise the debt ceiling to $31.4 trillion in December 2021³. At that time the Democrats controlled both the House of Representatives and the Senate, so the increase while not a complete formality was achieved without any major upsets. Now however, due to last year’s mid-term election results, the Republicans have edged control the House of Representatives⁴. This is where matters get complicated, because to raise the debt ceiling both the House of Representatives and the Senate must vote in favour. So now the debt ceiling has become a political football to kick around.

At this point I should point out this is a very different situation to the 35-day US government shutdown that occurred in 2018-2019⁵. Every year Congress also must agree on a budget that determines its level of spending for the next fiscal year. If this cannot be agreed Government employees don’t get paid. This means National Park rangers don’t get paid and furloughed. Which is very different to not paying your debt holders.

Readers with an eye for detail will have noticed that the current debt ceiling of $31.4 trillion appears to have already been breached with debt currently at $31.45 trillion. This is indeed the case; the debt ceiling was breached in January of this year. The US Treasury can enact emergency funding while Congress works to get a new debt ceiling approved. That though, is a stop gap measure with a finite lifespan. Current estimates are that those “extraordinary measures” the Treasury are taking will hit their limit sometime next month⁶. If by that point Congress has not agreed a new debt ceiling, the US will not be able to service its national debt and will begin defaulting on its debt payments. Also known as financial Armageddon.

The reality is that an agreement will be reached that allows for an increase to the debt ceiling. Indeed, one may have been reached by the time you’re reading this article. The stakes seem too high for the Democrats and the Republicans to not reach a compromise that allow Congress to agree on an increase. Positively there is also a little dab of self-interest for the politicians to reach that comprise, because they’ll likely not be paid due to lack of funding if the US does default on its debt.

¹Understanding the National Debt | U.S. Treasury Fiscal Data

²Understanding the National Debt | U.S. Treasury Fiscal Data

³Federal Debt and the Statutory Limit, February 2023 | Congressional Budget Office (cbo.gov)

⁴House Midterm Election Results 2022 | CNN Politics

⁵Government shutdowns in the United States - Wikipedia

⁶Federal Debt and the Statutory Limit, February 2023 | Congressional Budget Office (cbo.gov)

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here:

https://castlepoint.sharepoint.com/:f:/s/Consultant/EsyXv-TcMlpDn8nDLVXk8tsBWBOMAeERgXPKwmjt8aVzeA?e=BJbuYg

More information can be found at:

www.castlepointfunds.com

Comments

No comments yet.

Sign In to add your comment