By Greg Smith, Head of Retail at Devon Funds

Markets had plenty to deal with again in May. Investors largely moved on from the turmoil in the regional banking sector but had a new ‘crisis’ to deal in the US debt ceiling standoff. Central bank manoeuvrings remained in the spotlight, with officials suggesting that rate pauses were in the offing. For the most part, inflation continued to head in the right direction, making for an interesting backdrop to budgets delivered during the month in Australia and New Zealand, with the latter best described as “expansionary.”

Earnings seasons on the whole were positive, and while there were some misses, better-than-feared outcomes were generally a theme.

Most markets drifted lower in a month which has historically not been particularly kind to investors. There were however upward re-ratings for several companies within the Devon funds, the most notable being Ryman Healthcare (+20%) in New Zealand and James Hardie (+10%) in Australia.

As we move towards the half-way stage of the year, two drivers of equity market volatility – inflation and interest rates – appear to be heading for calmer waters. Inflation, while still elevated, has come down from peak levels in 2022 and is helping central bank officials to ratchet back the pace of interest rate hikes, or even pause them.

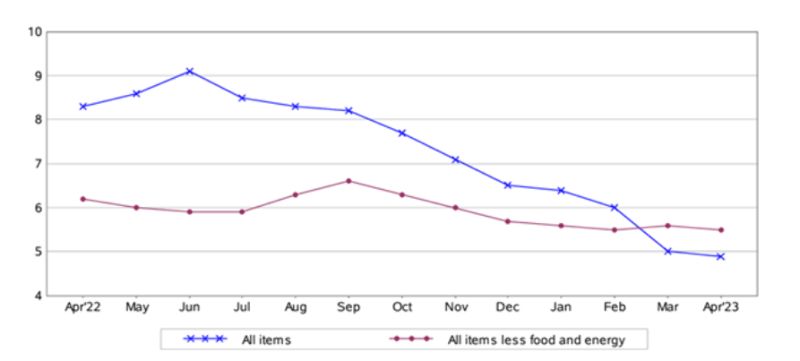

The Fed put through a widely anticipated 25bps increase in interest rates at the start of May. Chair Jerome Powell however implied that that “the door was open” to a rate pause. Helping the case here were US consumer prices which rose 4.9% in April, the lowest since April 2021, and well below the peak of 9.0% in June 2022. Powell also said any recession would hopefully be mild. Encouragingly, the latest jobs report had wage growth moderating even as the level of job creation (+339k in May) remains very strong.

US CPI

Source: US Labour Department

A Fed rate pause would be very well received by markets. Stocks have typically gained in the months after central bank decisions to pause rate hikes (with the exception of 2000, post the dotcom bubble bursting). The S&P 500 rallied some 30% in the 12 months following the central bank’s decision to stop hiking rates in December 2018.

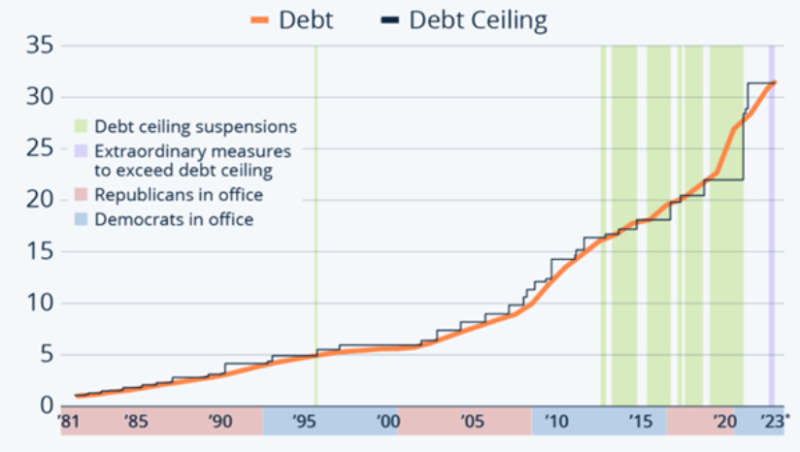

A fly in the ointment could however have been an impasse over raising the US$31 trillion debt ceiling. The standoff was however resolved before the ‘X-date” of June 5 (at which point in theory the US government would run out of money to pay all its bills). Both sides (Democrats and Republicans) made concessions, and The Fiscal Responsibility Act made its way past lawmakers. Much ado about nothing? The debt ceiling has risen consistently through the years regardless of which party is in power, and according to the 14th Amendment, anything which sees the US default on its debt is ‘unconstitutional.’

Debt Ceiling (US$ trillion)

Policymakers and central bank officials in Australia and New Zealand were both prominent during the month as well, with the delivery of budgets and rate decisions, which had some elements of predictability, but also some surprises.

The cost of living was a big focus for the Australian budget which sees some A$15b in support over the next four years, along with an element of “future proofing” with A$4b directed towards the renewable energy sector. Some fiscal responsibility was exercised, given the economy is expected to slow (but not too much) in the coming years. Funding the other side includes an increase in the tax on earnings on superannuation balances. The budget was back in the black for the first time in 15 years, and at A$4.2 billion, is a huge turnaround on the A$37b deficit forecast back in October. It is also the first surplus under a Labor Treasurer since 1989/90 (under Paul Keating).

Any notions of a budget surplus in New Zealand were washed away by the storms. The ‘no frills’ budget was effectively an election pitch and also saw a big focus on the cost of living. Funds also went to cyclone relief ($1.2b), education and public housing. Fuel subsidies are going however, and petrol, still a big cost for many families, will be going up in price. A $6 billion pledge was made to make infrastructure more “resilient.”

A notable component was that the trustee tax rate has been upped to 39% to align it with the top marginal tax rate. This will bring in $350m per year but will also make the tax advantages of PIEs for investors in funds very much more attractive. The maximum tax rate for PIEs is, and has always been, 28%. If a trust has funds in TD’s or investments in publicly traded companies, there is increasing merit to shifting these into a PIE fund. This has always been an available option to trusts, but with the tax rate differential soon to be 11%, it becomes a far more significant opportunity than it once was.

Increased NZ government spending will see gross debt rise to 40% of GDP by 2027. The more immediate economic outlook has improved with GDP forecast to grow 3.2% this year and 1% next year. Unemployment is now expected to peak at 5.3%. While the stimulus handed out will be inflationary, the Treasury is predicting that inflation will fall to 3% by next September. That said, around $20b more Government bonds than previously expected will need to be issued. If accurate, some other outcomes will be better than feared and a recession will be avoided.

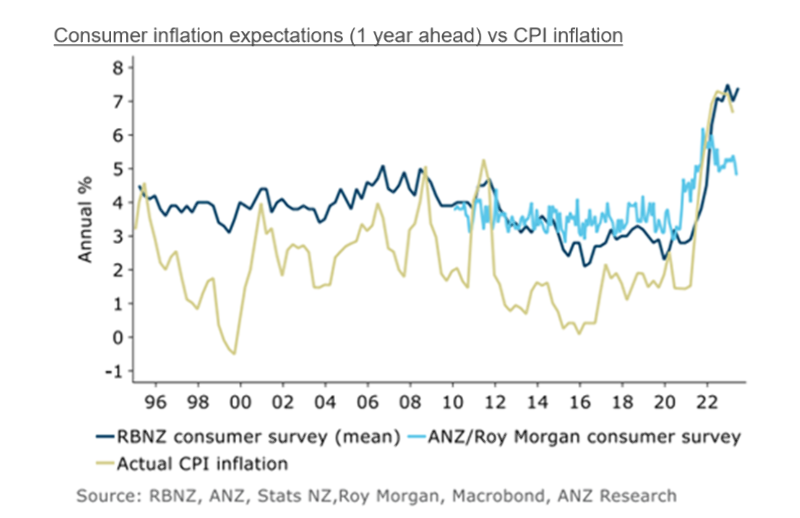

The Reserve Bank however has acknowledged that parts of the economy have already cooled substantially. Officials increased rates by 25bps in May, but gave a less hawkish outlook than anticipated, and appear to be looking through the inflationary impacts of the cyclone and the expansionary budget. Inflation is expected to reach 3% by the middle of 2024, and fall further to 2% by the middle of 2025. Governor Adrian Orr did however suggest that some optionality on future rate moves was being “retained.”

Back across the Tasman, the RBA’s approach appears to have been more “fluid.” After putting rates on hold, officials increased rates by 25bps during the month. Officials cited that while passed its peak, inflation (8.4% in December 2022) was still too high. The recent CPI release which delivered an upside surprise (coming in at 6.8% in April) provides credence to that decision and has resulted in the RBA putting through another 25bps rate rise in early June.

Better than feared outcomes have been a feature of earnings season both at home and abroad.

In the US nearly 80% of the S&P500 companies beat earnings expectations when they reported. There were some misses (Tesla a high profile one) but generally companies are coping better than expected with inflation and demand challenges, and are not overly pessimistic about the outlook. Supply chains are continuing to free up, as evident in the result from Apple. The results from the iPhone manufacturer also highlighted the strength of the consumer, even while some are ‘trading down’ in some more “staple” segments amidst cost-of-living pressures (as evident in results from Walmart, the world’s largest retailer).

May was also the month when the frenzy over Artificial Intelligence really kicked in. Nvidia soared after a very strong result, underpinned by accelerating demand for chips used in AI. The company is on the cusp of joining an elite group of stocks with a US$1 trillion market cap.

In Australia, there was clearly much interest in the results from the banks, with the view that this may be “as good as it gets” for the sector, which has been generating super-sized profits.

National Australia Bank’s first half numbers were positive, but not as strong as expected. Cash profit surged 17%, allowing the dividend to go back to levels seen in late 2019. The bank’s return on equity at 13.7% is back at the highest level since that year. The bank’s four divisions delivered double-digit underlying profit growth, with the BNZ unit (which NAB owns) a standout.

For the group, the pace of margin expansion has eased, and this was a common theme across the sector. A similar trend was evident in provisions for bad loans, which have increased but remain at historic lows. Borrowers appear to be coping generally well despite many facing much higher rates of interest.

One of the standouts in the earnings season was James Hardie. Shares in the building materials company soared after they reported a 12% gain in net profit for the FY23 financial year to US$512 million, and a sharp turnaround from three consecutive profit downgrades in previous quarters. Global net sales increased to a record US$3.77 billion, with records in all three of the company’s operating regions (North America, Europe and Asia Pacific).

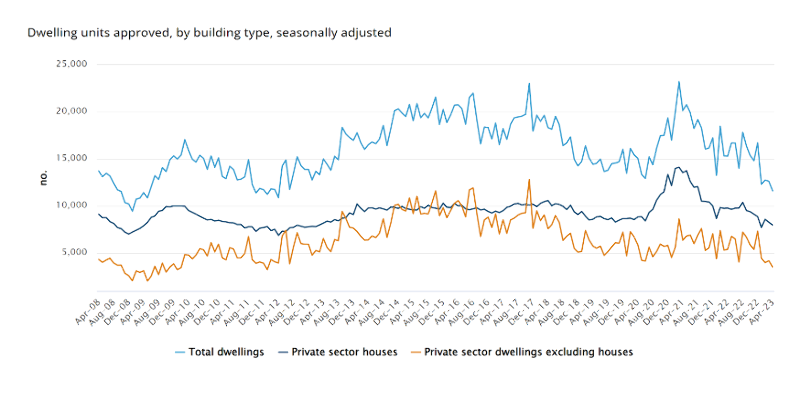

March quarter revenues in Australia and NZ increased 2% despite a slowdown in the housing market (new consents in Australia are the lowest since 2012). Although sales volume fell 10%,James Hardie was able to counter this through prices rises. Management lifted prices 12% in the March quarter. The company has been winning market share and taking out costs to support margins further. James Hardie is held across a number of the Devon funds.

Source: ABS

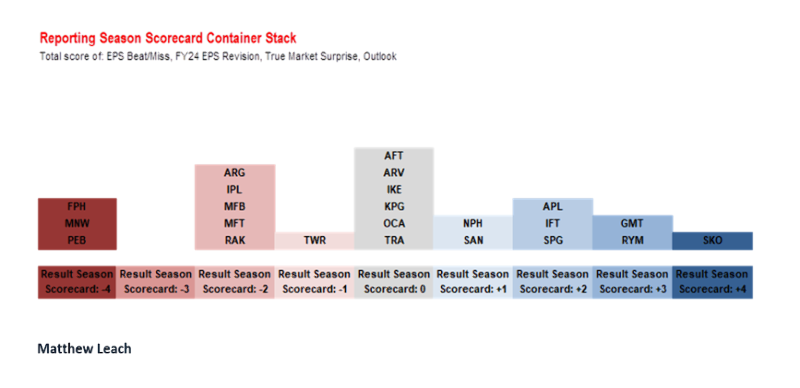

The New Zealand earnings season could possibly be described as more of a mixed bag.

Mainfreight extended its strong financial track record, with revenue and profits growing for 13 years consecutively. The dividend was raised 21%, but there was caution over the outlook, with a slowing economy dampening activity (their business in the Americas was the weakest). Mainfreight was a pandemic beneficiary as congested supply chains drove up sea and air freight rates. These tailwinds are now moderating.

Covid tailwinds have also eased for Fisher & Paykel Healthcare (FPH). Hardware sales have declined, as have consumables with hospitals running down inventories. The company is now investing for future growth and two new key products (Evora full mask for sleep apnea and their Airvo 3 device for nasal high flow) have been positively received. Overall management believe they can get margins back from 59% to 65% over the next 3-4 years. Revenues are expected to grow to about $1.7b in FY24. FPH is seeing its business perform in a pre-Covid way, and their shares are effectively back at levels seen just prior to the pandemic.

There was a lot to like about the results from Ryman Healthcare. While the bottom line was weighed down by lower revaluation gains, underlying earnings were strong, rising 18.4% to $301.9 million, ahead of the company’s guidance of $280-290m. Margins have been strong, growing from 20% to more than 30% in some areas.

Resales margins are robust and there is a growing contribution from the Australian business. Aged care occupancy improved to over 96% for mature villages.

Following on from Ryman’s recent capital raise, there was plenty of comfort around the balance sheet. Net debt fell to $2.3b, down from $3b at September 2022. The company is committed to achieving positive free cash flow by FY25. Ryman is repositioning its development pipeline with a focus more on lower density, “broad-acre” projects. Underlying profit is expected to be in the range of $310-$330 million for FY24. There are no dividends at this stage, but these could resume next financial year. Ryman Healthcare shares have rallied since the result, and time will tell if investor sentiment continues to improve further from here.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and last year launched two new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

Comments

No comments yet.

Sign In to add your comment