In Australia Westpac is re-engineering its home ownership model and hopes to fully digitise the home loan process.

McLean says in New Zealand they are heading down the same path but working on “bits and pieces”.

One of the exciting things is the bank starting to learn how to use the data it has on customers.

McLean is a big supporter of Open Banking. Open Banking is where a bank shares customers’ financial data with trusted third parties, so the information can be securely integrated into a variety of apps and digital products.

McLean says if a customer consents, then the bank could share information with mortgage advisers.

“Open Banking is something the mortgage broking industry could use to its advantage,” he said.

Westpac doesn’t fully disclose how much of its business comes through mortgage advisers, but McLean says it was about a third.

“We see mortgage brokers as useful partner for us,” he said. “They fill a very important need for a segment of the market.”

When pushed for a number he said; “i don’t think it’s a secret.” However, the bank’s external relationship people said: “For the industry they are around the 40% mark and we’re in line with the market.”

Westpac, like its competitors which reported last week, reported strong results in the deposit taking market.

Unusually, the bank has raised enough money in deposits to self-fund its lending operations in the six-month period.

McLean says that on average its deposits only fund 77% of lending. He said this situation was partly because home loan growth had been slowing.

Westpac home loan book grew 4% and now sits at $48 billion. However, the growth in this six month period was at levels below system growth.

McLean said it was a matter of the bank selectively choosing “where we want to compete hard and where we don’t.”

Two areas it is not keen on are lending over 80% and it is also cautious on commercial residential developers including apartment developments.

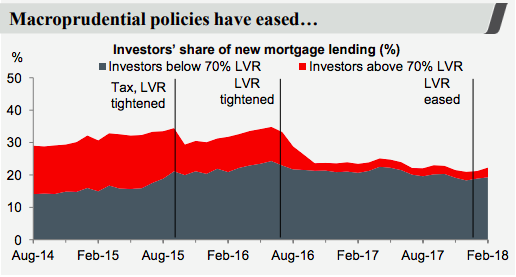

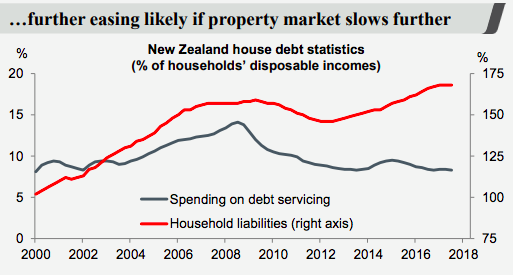

The bank suggested if the housing market continued to soften then the Reserve Bank may ease some of is macro prudential rules. However, that was a decision for the central bank, McLean said.

One of the issues facing the housing market is that the government is planning many changes such as a foreign home buyers ban, extension of the bright line test and KiwiBuild.

“No one,” he says, “is clear” on what all the combined government polices will mean for the market.

In the meantime Westpac expects activity to continue at current levels for an extended period.

Westpac increased its net interest margin 19 basis points to 2.15%. McLean said it was Westpac “catching up” with its competitors.

“We have the skinniest (NIMs) of the majors,” he says.

“It’s work we had to do to catch up.”

Westpac NZ posted a 4% rise in cash earnings for the six months to March 31. They rose $19 million to $482 million compared to the corresponding period last year.

Westpac reports differently to other banks in New Zealand as it only issues a cash profit figure, rather than a net profit after tax figure. The net profit figure becomes available when the bank's general disclosure statements are released.

Comments

No comments yet.

Sign In to add your comment