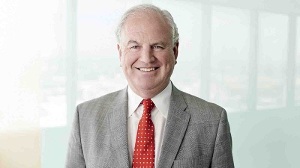

Westpac chief executive David McLean says while mortgage advisers “are a very important channel” to the bank, it has no plans to grow the segment.

The bank doesn’t disclose the amount of business it gets through mortgage advisers, even though other banks do.

Westpac chief financial officer Jason Clifton says “the market tends to work at about one-third of business being written through brokers.”

“We think of that through the cycle, as opposed to a particular number that we’re aiming for at any point in time.“

Clifton says “We don’t see customers wanting to use brokers more than they have over the last couple of years.”

Like other banks Westpac is increasing its digital offering and expects more business to come through those channels.

In the second half of the bank’s most recent financial year 27% of sales came through digital channels compared to 18% in the first half of 2016.

In Australia more than 50% of home loans are originated through advisers and ANZ chief executive Shayne Elliott, last week, predicted that market share would increase to 70% in the future.

McLean can’t see the same happening in New Zealand. He says the Australian market differs because there are a lot of non-bank lenders who can only use advisers, and Westpac is pushing digital sales.

“We’re not sure whether those market differences will flow through or not.”

“We don’t see ourselves inevitably going down the track which would lead us to the same percentage as Australia, but at the moment, and for the foreseeable future, brokers have an important part to play in the market.”

Why no over 80s

At one stage, you weren’t doing over 80% with mortgage brokers. Is that still the case?

McLean says Westpac’s decision to stop doing mortgages over 80% through advisers is about trying to manage its limits under the Reserve Bank rules.

“The dynamics are such that customers come in for approval, we might have an internal limit of below 10%, and you’re trying to manage that. If the market suddenly slows, what seems to happen is that the over-80s still proceed with their transaction, but the under-80s don’t necessarily, or it’s a different rate?

“So, what we thought we were operating to at a limit can get us closer to breaking it. That’s where we sometimes have to pull a bit harder on the lever,” he says.

The numbers

Westpac reported cash earnings of $970 million for the 12 months to September 30, up from $886 million the previous year.

Underlying earnings for flat for the year and the overall increase was due to a write back of $76 million, from dairy and long-standing corporate debt.

McLean described the result as “Very solid result in a competitive environment.”

Home loan delinquencies over 90 days are running and 0.12% and that is “about as good as it gets,” he says.

Westpac had increased margins on its home loans during the year due to “disciplined growth and repricing of mortgages and business lending, partly offset by lower deposit spreads.”

However, overall its home loan grew around 4% which is well below system growth of 6.5%.

McLean says the bank was being cautious in a very buoyant housing market, and trying to protect its margins.

He says in the long-term the bank aims to grow its market share, but it is also prepared to take tactical positions.

The bank has been looking at the housing market and expects the new Government’s proposed policies will “see growth in market being low for much longer than previously thought.”

“Our wish list is we would like to see house prices stay flat for an indefinite period,” McLean says. “What we don’t want to see is a big downward correction house prices which would have the effect of destroying a lot of wealth.”

The affordability issue would be addressed by the market staying flat and wage growth rising.

Comments

No comments yet.

Sign In to add your comment