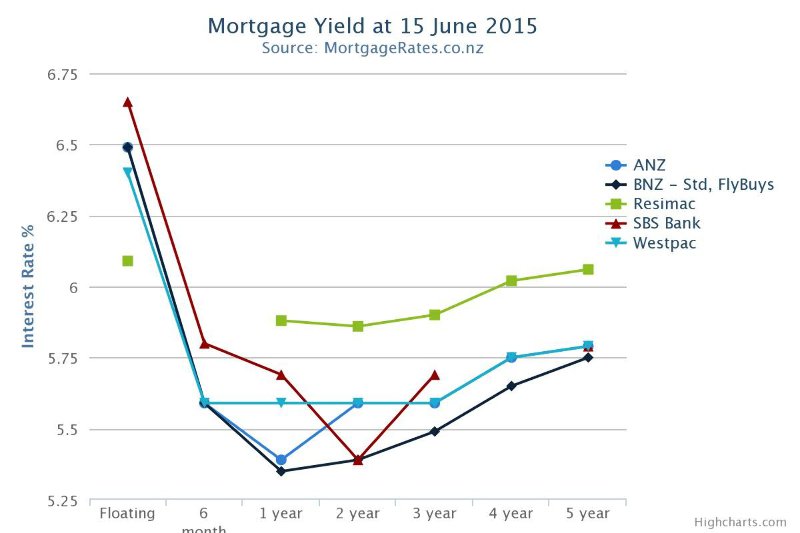

In the graph we have compared standard rates from Westpac and RESIMAC (who both won awards at the PAA Conference), BNZ which has recently re-entered the mortgage adviser market and SBS; A bank which has traditionally been a market leader.

The key points in this comparison are that SBS are only competitive in the two-year space. Here is it actually more competitive than it appears as it has a special rate of 5.35% which puts it right at the head of the pack when it comes to pricing. Normally SBS is a leader across the market, but not this morning.

BNZ is also interesting to include as it has competitive pricing on all its rates across the market. Here we have used its Standard rate.

The key point about RESIMAC is its very sharp floating rate, but this is a little hard to pick up at first as it is missing a data point in the series (a six-month rate). As you would expect it has trouble competing with the big banks on standard fixed rates.

ANZ, as it is the biggest bank in New Zealand, is included. Its standard pricing is nothing too remarkable. However it too has a good two-year Special rate of 5.39%.

The graph is only a snap-shot of what's available in the market. Other great rates at the moment are HSBC's 4.95% one and two year fixed rates, and the other sub 5% rate in the market is The Co-operative Bank's 18-month rate priced at 4.99%.

Comments

No comments yet.

Sign In to add your comment