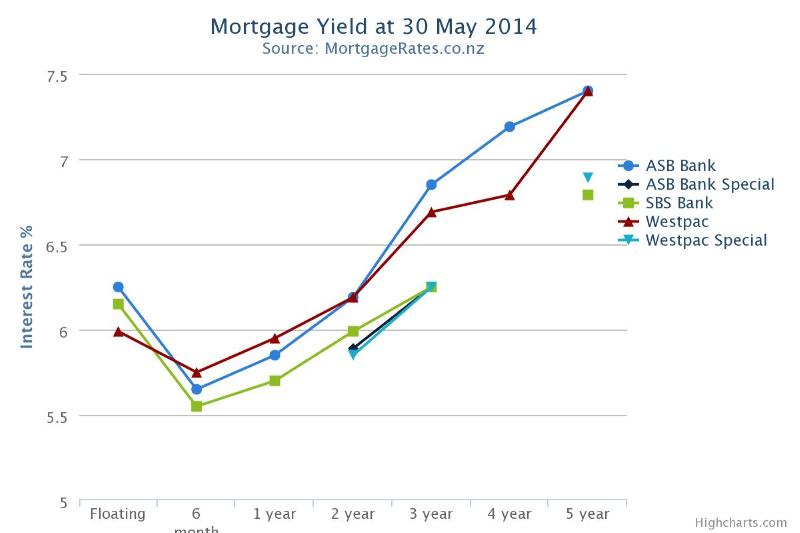

The key trends have been for six month rates to rise and longer maturity rates to fall.

The most competitive space at the moment is three-year fixed rates where 6.25% has become the leading rate and offered by most banks.

The big difference though is that the smaller banks tend to have it as their standard rate and the big banks are making it a “special” with terms and conditions such as a 20% deposit, salary direct credits and so forth.

We have illustrated it in our yield curve graph. This week we have deliberately selected a SBS as it tends to be the market leader on pricing at the moment, carded, standard rates for ASB and Westpac, and then their “special” two and three year rates.

The graph shows that the big banks are matching on specials, but not standard rates.

Good opportunity to fix?

Westpac chief economist Dominick Stephens says with New Zealand economy coming off its peak and subdued global inflation financial markets are pricing in lower interest rates.

Most economists are picking the Reserve Bank will increase the official cash rate next month, but views are mixed on whether there will be increases in July and September.

These views are pushing two and three year swap rates lower, consequently driving down interest rates.

Stephens is of the view the central bank won’t ease of its programme of OCR increases.

“In my view financial markets have overdone this. Two and three year mortgage rates and swap rates are too low.

“There maybe good opportunities for borrowers to grab some of these low two and three year mortgage rates and fix their interest rates.”

Comments

No comments yet.

Sign In to add your comment