Kiwibank economists, in their usual blunt way, are telling the Reserve Bank enough is enough.

“Our latest economic report card proves that restrictive monetary policy has done enough damage to restrain inflationary pressures. Enough is enough.”

“The RBNZ are responding – late, but in earnest.”

They says a rate cut in October is “as close to a done deal as you get.”

“In fact, we’d argue the only discussion should be on delivering 25 or 50. We’d advocate 50. And again, 50 in November.”

The goal should be to get to an OCR of between 2.5% to 3%.

“We argue the RBNZ needs to get the cash rate below 4%, asap. It takes up to 18 months for rate cuts to filter through the economy.

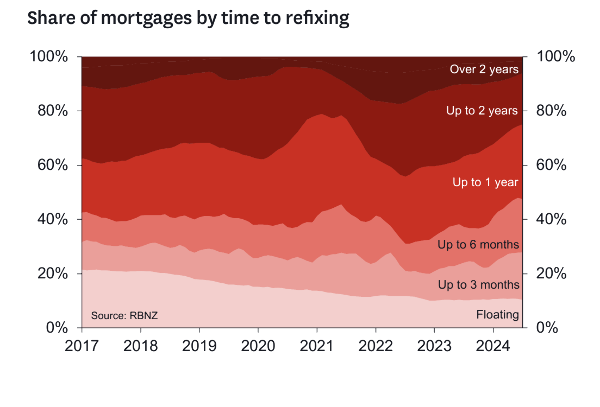

“We all love fixed rates. And fixed rates need time to roll off. Effectively, the RBNZ are cutting today for an economy at the end of 2025, the start of 2026.

ASB Bank chief economist Nick Tuffley is more circumspect saying “there is little in (last week’s) data to have the RBNZ rushing to cut the OCR by more than the 25 basis points per meeting that most people have settled on as the likely path forward. “

“But the US Fed’s move has spurred greater speculation of OCR cuts in New Zealand.”

He notes that the market is pricing in more than 80 basis points worth of cuts in the RBNZ’s last two meetings this year. That implies “a done deal that one meeting will deliver a 50 basis point cut, or a decent chance of both meetings delivering 50 basis point cuts).

“Pricing by the February meeting is over 125 basis point, in effect two 50 basis point cuts and a 25 basis point cut over those three meetings.

“That is a lot built in. It will be the data that dictates the pace, mapped against the implications for the RBNZ’s inflation outlook.”

Given that softening in economic conditions, we’re forecasting that the RBNZ will cut the OCR by 25bps at its next two meetings, with further gradual cuts pencilled in for 2025.

That would see the cash rate falling to 3.75% by the end of next year. In contrast, financial markets are pricing in the chance of more front-loaded rate cuts. Market pricing is currently consistent with at least one 50bp cut this year, and deeper cuts over 2025.”

Even though the RBNZ has only cut the OCR by 25 basis points thus far, borrowing costs for households have fallen much more sharply. Since 31 July (before the RBNZ’s August OCR cut), one-year fixed mortgage rates have fallen by around 60 basis points and two-year fixed mortgage rates have fallen by 75 basis points.

“It’s also worth noting that borrowers have been rolling on to shorter fixed-term mortgages over the past year in anticipation of rate cuts. That means that, although it will take time for rate cuts to ripple through the economy, by the end of this year close to half of all borrowers will have rolled on to lower rates.“