By Alan Henderson - Co-founder and director Erskine Owen

Before we delve into this, it is important to understand how commercial property is valued. Generally s valuer will take the net income and capitalise that income using a capitalisation rate.

For example, if the rent is $100,000 and the capitalisation rate is 10%, then $100,000 divided by 10% gets a value of $1 million. Where does that cap rate come from? It is based on comparable sales, but then an adjustment for inferior and superior will be made up of many more variables – length of lease; quality of tenant; rent review mechanisms; tenant covenants; industry; etc.

What this highlights is the importance of income – the amount of it, the certainty of it, and the potential for growth. That means a vacant commercial property is usually worth a lot less than if it was occupied.

Therefore, adding value to commercial property is all about increasing and strengthening revenue streams. Let’s look at ways this can be done.

It is possible to add income streams separate to the main tenant income that haven’t previously existed, thus adding value. Here are a few to think about:

Lease out spare land

We have a block of five small industrial units in Frankton, Hamilton. When we bought the property there was a 600m2 piece of land at one end that had a residential house on it until it burned down.

We fenced it and leased that area to a builder, who stored his machinery on it. That produced about $10,000 per annum of additional rent. At the time the cap rate was about 8%. We added $125,000 of value and with $5,000 of costs taken off that generated a net capital gain of $120,000. We had paid $600,000 for the property, putting no money into the deal as we leveraged other property. Not bad for half a day’s work co-ordinating a fencer and getting the local agent to find a tenant.

Lease carparks

We bought a Hastings property from a taxi company, which decided it did not need the single level commercial building on the front of the site it leased back and parking at the rear. The taxi company decided it did not need the parking, fenced it off and signed a long-term lease with the police for their use.

That created more income, and we were prepared to pay more for that building than if it just had the taxi company lease because it helped with our holding costs. We wanted it for another purpose which would allow for greater value add.

Repurpose for higher value

We bought the corner site next door to the former taxi premises, which has an old run-down two-story villa on it with a commercial tenant and a small amount of residential.

We now have a government department asking for accommodation and if the site is signed for redevelopment, the government will buy the finished product from us. The price will be cost plus an agreed margin. That takes a huge amount of the risk out of it.

Billboards

We have never done this, but we’ve come close to buying a building where the vendor had bought an office block on Nelson St in Auckland’s CBD and got tenant and council approval to put up a couple of digital billboards. All the 5pm traffic heading for the motorways sit and look at the billboards. Valuers don’t attribute as much value to this type of revenue as it can be more volatile since billboard companies will pull away in a recession. Nevertheless, over time the cost benefit stacks up.

ATM machines

Banks charge transaction fees when clients withdraw cash from an ATM. That means the banks are prepared to pay rent to a landlord to get a space in a high traffic area. The great thing is that they don’t take up a lot of space.

We are planning to attract one of the main banks to put a machine in at Amberley, Canterbury’s syndicated Brackenfields shopping centre. We should get $20,000 a year in rent. This property has an 8.5% cap rate – so it should add more than $235,000 of value to the property.

Cell masts

Similar to billboards – telco companies will rent space on a commercial property’s roof for the right to put a cell tower there. There is probably less of this new leasing happening now, but worth keeping in mind.

Buy a vacant property – lease it

Why would a vendor not do the work themselves to get it leased? Often they have lost the energy for the property – the tenant leaves, the make good clause in the lease is weak, there is no money or willingness to renovate or refresh the property and so the vendor decides to move on. That is an opportunity.

This process will often require some renovation work to attract a quality tenant. This also means it will require a bit of vision. Get on the ground and find out what tenants are looking for. If it is an industrial property, is it that the space is too big and it could be split into several units for which there is more demand, and where the per square metre rental rates are likely to be higher?

Going down this route means allowing for architect costs as well as renovation costs. But don’t be put off. Sometimes it is just a matter of a renovation that is relatively cosmetic – fresh paint, carpet and amenities always make a property more appealing.

Renovate

This is similar to the above – but with an existing tenant. Just because a tenant is in the middle of a lease it doesn’t mean you can’t renegotiate it. Why would you do that? If they are coming, to say, the end of their six-year lease and there is two years to run, plan to begin the “what are you plans” conversation at least a couple of years out to secure their tenancy.

A great way to do that is to understand what the tenant’s pain points and see if you can fix them.

For example, we looked at buying The Warehouse site in Alexander, Otago pre-Covid. The lease was coming to an end, and we found out The Warehouse wanted new lighting and if it is was completed the company’s head of property would be prepared to engage in a lease re-negotiation.

However, we were then told the process couldn’t start until consultants McKinsey had completed a new group strategy. We let the deal go, but we do know another party bought the property, did the lighting and now there is a longer lease.

Sometimes it might be simpler than that – it could be a lick of paint is all the tenant needs, or it could be more complex. One of our team members was manager of a shopping centre and the café set-up wasn’t working. They designed a food hall that didn’t feel like a food hall. It is a massive success.

We have bought an office block in Christchurch at an 8.4% yield. The carpets and bathrooms are a bit tired and over time we will refresh the interior and in turn negotiate higher rents as rent reviews come up.

We are also planning to make the building greener. Banks love this and are prepared to offer a discount on interest rates and prioritise lending if your building is green.

A new carbon emissions programme the government has signed up for means that corporates are measured on how ‘green’ they are. If they are lending on green assets – that is good for them.

What that means is that if we make a building green it will make it easier and cheaper for the next person to get bank funding…and thus increase buyer demand.

Lease negotiation

There are things that can be done with a lease that can have big value impacts. When signing a new tenant, or agreeing renovation works with an existing tenant – take time to negotiate each term.

For example, if renegotiating a lease, you could agree a higher rent in exchange for a rent-free period and some capital works meaningful to the tenant. The benefit of this is that a higher rent will increase the value of the property. And, the rent-free period doesn’t necessarily have to cost you over the term of the lease.

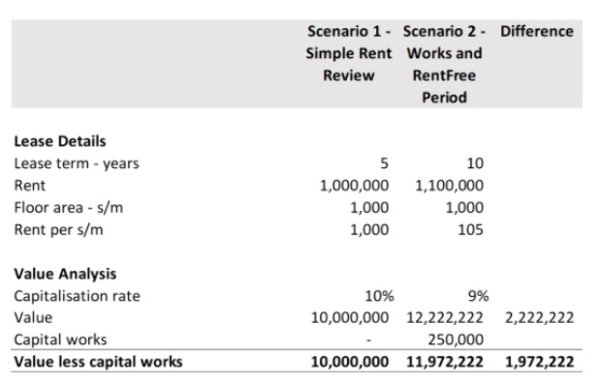

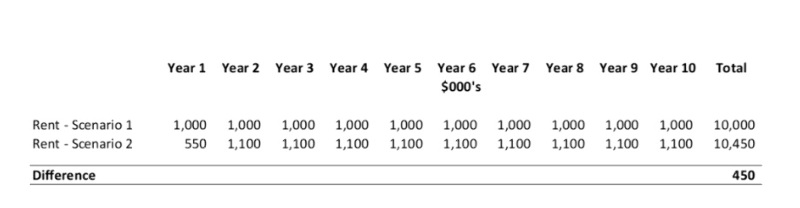

Let’s look at an example. Scenario 1 below is simply increasing the rent and the tenant exercises their five-year right of renewal. So, $1 million of rent, the valuer puts a 10% cap rate on it, and therefore the value is $10m.

However, that’s not exciting, so take the tenant out for coffee and chat about where they are going with their business, understand the vision they have and where they want to go. Say, it’s a growing manufacturing business and you find out they have a separate operation elsewhere and want to bring the office staff across to your building.

If you hire an architect and they say you can knock some walls down and create a more open workspace, the tenant gains enough space for 10 more desks. If the reception and boardroom are also painted and the Formica boardroom table replaced, a rent increase can be negotiated to $1.1 million – $100k more per annum than the base rent. Critically a new 10-year lease term can be negotiated.

This is easily justifiable. If money is spent on the property, you need to know there is going to be a return, and a five year lease increase won’t do it. To soften the blow, offer the tenant six-months rent free. Also highlight the saving the tenant will make from not paying rent for the other premises and the productivity and culture benefits from having all their office staff under one roof.

The financial result?

Value increase: The rent increases, which increases the value. And the valuer sees the 10-year lease and knows buyers like long solid leases and will pay a premium, so they put a better cap rate of 9% on it. The combined impact of the increased rent and lower cap rate means the value goes up by $2.2m. You have spent $250,000 to get that result and the net gain compared to Scenario 1 is just under $2 million.

Additional cashflow: You give up $450,000 of rent in year one, but over 10 years you gain an additional $450,000 of rent from the annual increase.

See the table below.

For a coffee with the tenant, a few subsequent phone calls, co-ordination of some works and perhaps financing for the $250,000, you have managed to improve your financial position by $2,422,222 (the value increase of $1.972 million plus the additional cashflow of $450,000). That’s worth getting out of bed for.