New Zealand and Australian share market returns over the month were dominated by profit results, earnings downgrades, and a sharp move up in long term US and New Zealand Government bond yields, which increased the return hurdle required by investors and dragged on returns for defensive shares and pre-profitability growth shares. While actual profit results for the June period were generally ahead of conservative expectations, weak earnings guidance from company management contributed to a higher-than-normal number of earnings forecast downgrades relative to upgrades. There was significant dispersion between individual share returns over the month - this was a market environment where being selective enhanced portfolio performance.

Central banks are continuing to agonise over policy settings that appropriately reflect inflation concern and slowing economic activity. At one end of the spectrum, the Reserve Bank of Australia maintained its policy stance at its August meeting, partly due to a substantial drop in consumption growth as households respond to cost-of-living pressures and higher interest rates. On the other hand, Federal Reserve Chair Jerome Powell emphasised the central bank's commitment to lowering inflation to the 2 percent target in his speech at the Jackson Hole Economic Symposium in late August. Powell noted that, despite progress evident in a further slowing in job growth and ongoing disinflation, more work was needed to achieve price stability.

Weakening trading-partner demand, driven by a slowing Chinese economy, has resulted in a significant decline in New Zealand's commodity export prices in recent months. This decline poses multiple challenges for our economy. The reduced export revenues are likely to have a negative impact on economic activity, potentially leading to a further deterioration in the fiscal accounts and necessitating additional bond issuance. The export weakness is likely to hinder the improvement of the current account balance, increasing New Zealand's reliance on the global economy and putting pressure on the country to attract foreign investment via a weaker New Zealand dollar or higher long-term bond yields.

What to watch – falling prices putting pressure on the agricultural sector

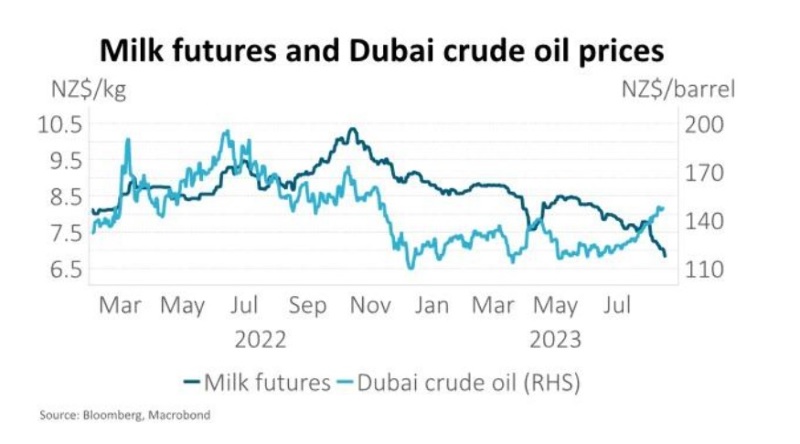

In early August, Fonterra reduced its 2023/24 season milk price forecast by $1 to a mid-point of $7 per kg of milk solids. With Fonterra collecting milk amounting to 1.5 billion kilograms of milk solids each year in New Zealand, this equates to 0.4% of GDP before indirect economic effects are considered. Some economists suggest the broader impact on the economy could be as much as 4-5 times the direct effect. $7 per kg of milk solids is also 15% lower than last season’s price of $8.20 and below most estimates of a breakeven rate. Dairy is our largest export, making up 30% of total goods exports or $22bn per year. Other key export prices have also been under pressure from slowing demand, including lamb and log prices. Meat and wood exports make up 12% and 7% of total goods exports, respectively. Unfortunately, farm costs have been moving in the other direction, putting pressure on the agricultural economy.

Market outlook and positioning

With the days getting longer and temperatures warmer, spring is emerging in the southern hemisphere. But occasional cold snaps and storms remind us that winter has not quite finished. Capital markets may not yet be in ‘spring’, but they may be past the ‘winter solstice’. We could be past peak inflation and its negative impact on economies and capital market returns, but sticky inflation components and the lagged impact of tighter monetary policy mean that it may be some time before central bank official cash rates are reduced, providing some support to capital market valuations (even then it is plausible that rates may be cut due to economic stress). Earnings forecasts have been reset lower to reflect slowing activity and higher costs, but the balance of risk is towards further downgrades in the near term. The local economy may also go into a holding pattern with New Zealand facing a general election in October. This backdrop suggests a mixed period of performance for the local share market. In this environment investments which benefit from secular growth trends, and reducing exposure to investments at risk of further economic downturns and financial stress may enhance relative returns.

The Reserve Bank of New Zealand (RBNZ) continues to believe it has done enough to tame inflation. We agree and expect Official Cash Rate (OCR) cuts from early next year. The RBNZ left the OCR unchanged at 5.50% at its August Monetary Policy Statement decision and made very small changes to its OCR forecast, demonstrating confidence in achieving its inflation target. The Monetary Policy Committee (MPC) noted that the current level of interest rates is limiting spending and reducing inflation pressure, as expected. It noted that global economic growth is below trend and many countries are experiencing declining headline inflation but persistent high core inflation. In New Zealand, the MPC highlighted that, despite easing labour shortages due to softening demand and increased immigration, core inflation remains elevated. The committee acknowledged the need for a prolonged period of subdued spending to align with supply capacity and reduce inflation. As such, the RBNZ forecasts the OCR to remain at current levels until 2025. We think there is already strong evidence that monetary policy is working, and less restrictive policy settings are likely from early next year.

Within equity growth portfolios our strategy remains to position for a range of scenarios and to be selective. We continue to favour investments with structural tailwinds that are less dependent on strong economic activity. We continue to see technology dispersion, de-carbonisation, and demographic changes as supporting company earnings. Businesses exposed to the energy transition and the onshoring/nearshoring of manufacturing and storage of goods may face opportunities and threats. We are also favouring companies with productivity and efficiency ‘self-help’ programmes, particularly where business re-engineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are less vulnerable to a tightening in financial conditions.

Within fixed interest portfolios we retain a meaningful long duration position, meaning portfolios will benefit from a fall in interest rates. Our investment strategy is driven by the medium-term view that the OCR is likely to shift downwards in 2024 and be much less restrictive. Exact triggers for this change remain uncertain, but they can occur either suddenly in response to shocks or gradually as the economic cycle unfolds. A period of heightened supply of corporate bonds has pushed credit premiums higher and provided an opportunity to reposition portfolios. For example, in August BNZ brought a 5-year senior bond to market at a premium of 100 bps (1%), approximately 20 bps over secondary market levels. This pricing is at our assessment of fair value, and we have been participating meaningfully in new deals, returning credit exposure closer to neutral.

The Active Growth Fund is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history, even considering recent falls in bond yields. While this is not a short-term indicator, it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities may shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. We are overweight fixed interest duration relative to our benchmark reflecting our view that, particularly in New Zealand, there is scope for interest rates to fall more than is priced in to forward curves currently. Further, as the markets focus on moves from inflation concerns to growth concerns, it is likely that equity and bond markets will behave in a less correlated manner. This means that fixed income should provide the portfolio downside protection during periods of equity market volatility, as it did earlier in the year when regional banking troubles surfaced.

The Income Fund’s strategy remains cautious, holding a below benchmark equity allocation, which has, in part, led it to post a positive return in the past two years in the face of weak equity and bond markets. Given the difficulty in picking turning points in real time, we have incrementally increased the Fund’s exposure to equities, but remain underweight. As with Harbour’s fixed interest portfolios, the Fund has begun to allocate less to government-related entities in the corporate bond segment, the largest portion of the Fund. While it retains a very low allocation to outright high-yield borrowers, as we believe that it remains appropriate to be cautious about the most cyclically exposed sectors, it has increased weight to the commercial property sector, which has seen yield premiums expand, possibly owing to the softness seen in commercial property markets abroad such as New York and San Francisco. It has done so via the bonds of a selection of New Zealand’s listed real estate landlords whose debt-to-asset ratios, akin to a loan-to-value ratio (LVR), typically sit in the 30%-40% range.

Article by Lewis Fowler, Investment Analyst, from Harbour Asset Management Limited. This content is not intended as financial advice.

Comments

No comments yet.

Sign In to add your comment