The investment firm’s Value of Advice report is now in its tenth year.

Russell Investments CEO Matthew Arnold says the biggest change since the first report in 2013 has been the role of the financial adviser.

“The days of ‘adviser as portfolio manager’ trying to pick hot stocks and identify star fund managers have given way to broader financial planning and wealth management.”

He says advice firms are increasingly standardising their processes and products, often partnering with specialist firms, while focusing on customisation and the overall client experience.

“That is the real value add of professional financial advisers today – personalised advice through the development of long-term financial plans that can adapt and evolve through time.”

The report takes four elements of professional adviser services and gives each one a numerical value, to arrive at an overall value add.

It aims to illustrate the ways in which advisers add value, and assigns an approximate value to those services, says Arnold.

The elements are A (active rebalancing of investment portfolios - 0.3%) + B (behavioural coaching - 1.8%) + C (customised experience and family wealth planning - 0.8%) + D (don’t lose sight of real returns - 3%) .

Ten lessons over 10 years

The report also looks at developments in the financial advice sector over the decade and found:

1.The adviser’s role has gone from being essentially a stock broker, picking investments for clients, to providing a wide range of services.

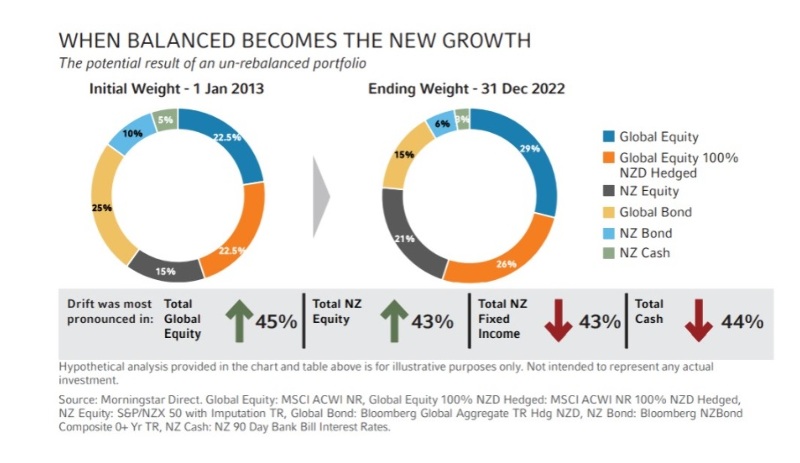

2.Without advice many investors do not rebalance regularly potentially introducing unwanted risks into their portfolios. Taking a typical balanced portfolio held from the start of 1985 to the end of 2022, an actively rebalanced portfolio has a 0.33% higher return per annum than one that wasn’t rebalanced.

3.Investors can be ruled by their emotions. Advisers can bring significant value as ‘behavioral coaches’, encouraging a long term view. Research found that in the 15 years from 2009-2023, the average investor’s returns were 1.8% lower than overall market returns, showing the value that can be added by keeping clients invested.

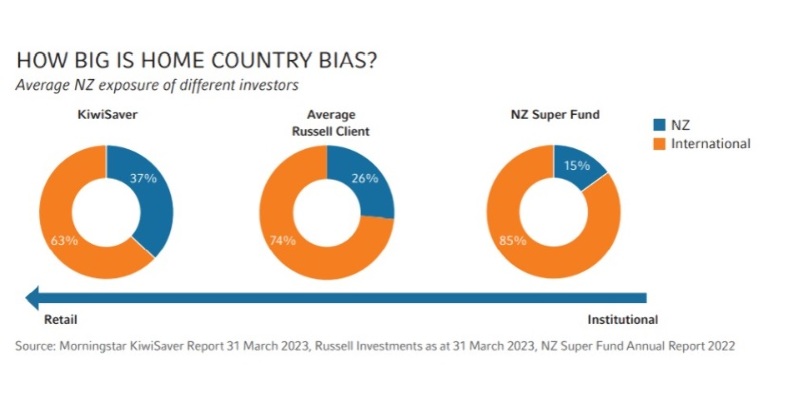

4.Home country bias remains dominant. For Kiwi investors this can mean lost opportunities, given the high concentration and reliance on a small number of companies on the NZ equity market. The 10 largest companies make up more than 60% of the listed market, where in the MSCI All Country World Index they account for around 18.

5.There is a growing demand from investors for a more personalised experience, and the ‘personalised’ means different things to different generations. Advisers need to contend with how to cater to the preferences and needs of each demographic group because advisers are now often providing holistic wealth management services to clients and their families, says the report.

6.Planning is an ongoing process. When done correctly it is not a one-time step and advisers should regularly adjust plans to align with clients’ changing circumstances. The report says advisers add considerable value shepherding a strategy from origination to outcome which means plan reviews, savings and investments analysis, looking at student loans and stock options, considering employee benefits, university funding and estate planning. To help, many advisers have built a network of expert partners including estate lawyers, insurance planners, accountants and even lifestyle consultants.

7.Successful advisers have partnered with service providers and platforms to deliver a better, more scalable service. Advisers are also increasingly talking to an investor’s entire family with US research suggesting that nearly 70% of investable assets will pass to the next generation by the start of next decade. The report compares the modern adviser role partnering with service providers to give a wraparound service to the original adviser role - selecting investments and developing a financial plan. Simple investment advice is estimated to be around $250, which assuming a $500,000 portfolio works out to a fee of around 0.05% AUM. An adviser providing more comprehensive family wealth planning on the same portfolio can expect to charge more - perhaps 0.80% or more AUM, says the report.

8.Advisers are adopting new service models to ensure it is spent building deeper client relationships. The report suggests advisers quantify how time is spent with clients to see which activities are high and low value and focus on those which generate higher revenue.

9.Real (inflation adjusted) returns are what counts.

10.Communication is key. One of the best ways for advisers to communicate with their clients is through a discovery process centred on trust, communication, prioritisation and dealing with critical life components such as: family and relationships, health and wellness, career and work, lifestyle and leisure, and community and giving. It’s a basic framework for our lives and the holistic wealth management ecosystem.

Visit russellinvestments.com/nz for the full report.

Comments

No comments yet.

Sign In to add your comment