Last year, global equities¹ fell 18.4% and global bonds² fell 17.5%. For investors in a traditional ‘60/40’ style portfolio, this was a miserable outcome with the worst performance since 1999³.

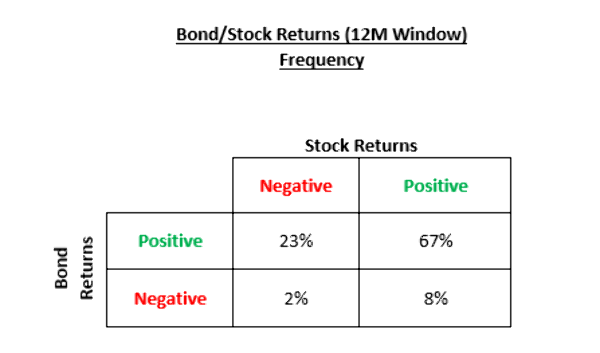

Thankfully, the failure of traditional bond and equity correlation is a rare event. Since 1926, negative equity and bond returns over 1-year happened only 2% of the time, as evidenced by the table below. But it does prompt discussions about what we mean by ‘diversification’ within our portfolios.

Data to Dec-22 from 1926, Bond = Bloomberg Barclays US Intermediate Treasuries, Stock = S&P500, Source: Goldman Sachs, Datastream, Investment Strategy Group

Portfolio construction wisdom tells us to maximise risk-adjusted returns (Sharpe ratio⁴). Or to determine risk tolerance and then attempt to maximise your returns for that given level of risk. This means, combining uncorrelated assets in a portfolio to improve the return for risk outcome.

Generally, bond/equity portfolios fulfil this dynamic, but there are years, like 2022, when their outcomes coincide on the downside and the results are very unappealing to investors.

So, what might have helped traditional investors in 2022? Ideally, investing in return generating assets which are uncorrelated with both bonds and equities. This would improve the level of diversification in portfolios and ultimately generate better risk-adjusted returns, not only in 2022, but also over the long term.

‘Alternative’ assets are helping to fill this requirement and are increasingly being seen as an important diversification tool. As evidence of their growing popularity, the asset class has increased as a percentage of total global assets from 5.5% in 2003 to 14.7% last year⁵.

But the term ‘alternatives’ is a broad and free-ranging category encompassing many different types of investments. As the moniker suggests, ‘alternatives’ is everything that does not fit into the norm. This could include Real Estate and Private

Equity as well as ‘hedge fund’ strategies. Some of these strategies correlate with broad moves in risk assets, others do not. Those that don’t are particularly interesting from a diversification perspective.

Strategies within the hedge fund universe like ‘Global Macro’ or ‘Managed Futures’ have over time been shown to perform independently of equities and can provide very attractive diversification properties to more traditional asset classes. During 2022, the Macro/Managed Futures index gained 4.1%⁶ while bonds and equity returns declined. Of course, there is no such thing as a free lunch – in periods of low volatility they tend to produce lackluster outcomes and choppy, whipsawing markets can yield negative returns. However, in a portfolio context, this is usually when equities are generating strong returns which offsets these outcomes. Again, the important aspect is the diversification benefit, rather than seeking a tool that performs in every environment – we know this is a unicorn that doesn’t exist!

Despite these attractive qualities, many of these types of assets remain unloved and under-represented within portfolios, particularly in a New Zealand context. This is understandable as barriers to entry remain high, access can be difficult and strategies complex. While Kiwi investors tend to have allocations to alternatives like real estate and private equity, either directly or via allocations to listed real estate companies, or shareholdings in a private company, other alternatives are not typically held in portfolios. With New Zealand domiciled funds, there are a limited number of quality products in this area. However, more tools are coming to market as interest in this area grows. We see this as a positive development for Kiwi investors. Increased diversification to a set of carefully selected alternatives will ultimately improve both portfolio diversification and enhance portfolio outcomes.

Sources:

¹MSCI All Country World Net Total Return Index (USD)

²Bloomberg/EFFAS Global Aggregate Treasuries Index

³Battered 60-40 portfolios face another challenging year | Financial Times (ft.com)

⁴Sharpe ratio is the average return of an investment or portfolio divided by the standard deviation of that investment or portfolio’s return

⁵Source: JP Morgan

⁶HFRX Macro/CTA Index

Disclaimer: Marek Krzeczkowski is Portfolio Manager and Ryan Falls is a Senior Analyst at Mint Asset Management Limited. The above article is intended to provide information and does not purport to give investment advice. Past performance is not a reliable indicator of future performance.

Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement here.

Comments

No comments yet.

Sign In to add your comment