At the risk of jinxing things and, barring a few weeks in March where the collapse of Silicon Valley Bank looked like it could create broader risks for the banking system, the first half of 2023 was relatively uneventful. Particularly when compared to the corresponding periods in 2020 and 2022.

After a year of negative returns for both bonds and equities, “the scores on the board” look healthier for both. Equities have bounced strongly with the MSCI ACWI returning 12.8% in local currency and technology-heavy indices like the NASDAQ are doing even better - up 31.7% in the first half of 2023. More defensive equity markets such as the S&P/NZX 50 (up 3.9%) have lagged. Bond returns have delivered positive returns of 2.7% for the Bloomberg Barclays Aggregate Index and 1.8% for the Bloomberg Composite Bond Index. Further, upward inflation surprises that were a feature of 2022 have dissipated and equity market volatility has fallen considerably.

In our 2023 Top 10 Risks and Opportunities article we noted just how downbeat the consensus was heading into 2023, which, in hindsight, created a low bar for upside surprises. Many Wall St strategists had negative return expectations for the S&P 500, investors were underweight technology stocks, and the US was widely picked to fall into recession by H2 2023. Today, the consensus paints a less bearish view. In recent months we have seen net upgrades to equity market price targets, positioning towards technology stocks seems to have moved to a more neutral to overweight position and the much-anticipated US recession has, so far, failed to eventuate.

This again reminds us that the greatest risks and opportunities in markets arise from consensus views, which ultimately prove incorrect and spur repricing. With that in mind, we consider what could move the consensus as 2023 progresses. Here are the five that are front of mind (plus a bonus risk!).

1. Where to for equities?

Equities markets had a strong bounce in H1. Digging into the numbers, the performance was driven by a small number of sectors and stocks. Information Technology and Consumer Discretionary stocks did most of the heavy lifting, contributing to 69% of the MSCI ACWI’s return for the first six months of the year. An unwind of bearish positioning also helped drive returns upwards as did earnings which were not as bad as feared.

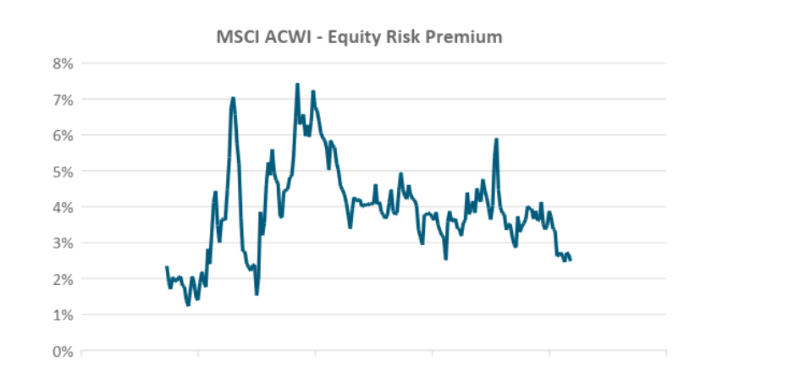

Looking forward to the rest of the year, we think the path higher looks tougher. Positioning is back to more normal levels and is, in fact, stretched in some areas of the market. For example, the ratio of bulls to bears within the AAII Investor Survey is back to 2021 levels. Valuations, whether based on the equity risk premium (sitting at 100th percentile compared to the last fifteen years) or Price to Earnings ratio (sitting at 82nd percentile compared to the last fifteen years) are not at attractive levels, acknowledging valuations are a poor timing tool. Further, manufacturing survey data, which has typically led the earnings cycle, potentially points to more softness in earnings to come.

Source: Bloomberg, MSCI. Equity risk premium is the forward 12-months earnings yield less the US ten-year bond yield.

2. Bonds continue to serve a useful purpose in a 60/40 portfolio

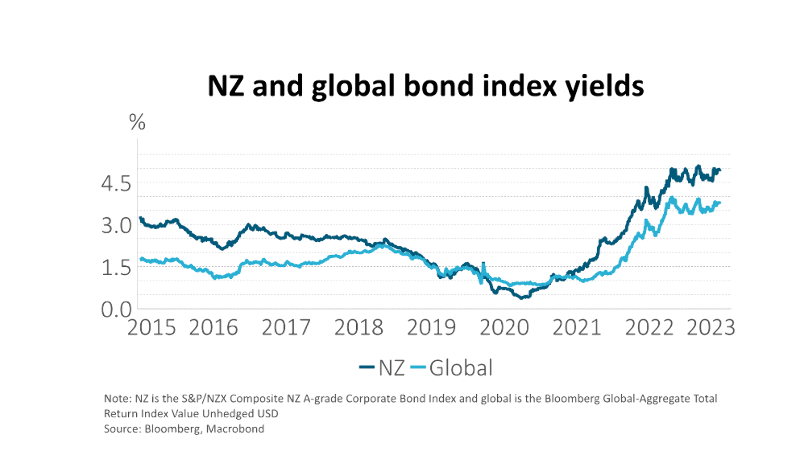

While long-dated bonds may be subject to weakness as investors demand more compensation for uncertainty, short-dated bonds offer great value with yields at elevated levels. We think bonds continue to serve a useful purpose in a 60/40 portfolio, as we did at the end of last year.

Sources of uncertainty include future real neutral interest rates, where inflation will settle, government debt levels and geopolitics, many of which we discussed here last year

But with central bank policy rates close to cycle highs, bond benchmark running yields are 3.5-5% in most countries. We think these are well above neutral rates of interest. This suggests that bonds continue to offer good levels of income and the ability to provide capital gain should yields fall more quickly than markets anticipate. March’s flight to safety, as investors worried about banking contagion, provided a live example of the defensiveness bonds offer as downside protection.

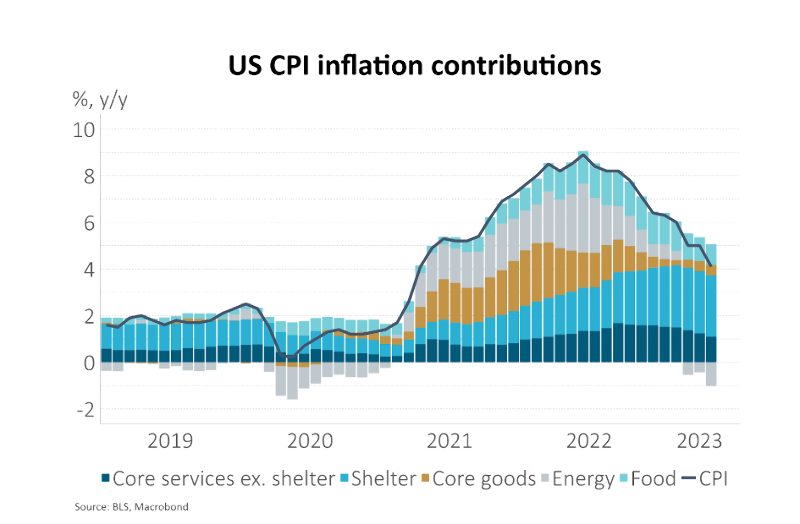

3. Sticky core US inflation requires policy to stay restrictive for longer, placing upward pressure on short-term interest rates

The US economy is proving to be surprisingly resilient. While CPI inflation has more than halved, helped by core goods disinflation and falling energy prices, core inflation remains sticky. Much of this relates to a still-tight labour market that is keeping services inflation high, including rents. The US unemployment rate is close to all-time lows at 3.7% and average hourly earnings are running above 4% y/y. One of the Fed’s favourite indicators of labour market slack, the number of job openings per unemployed person, increased to 1.8 in April – well above pre-COVID levels of 1-1.25 and arresting the decline seen in Q1.

Inflation persistence may necessitate further rate hikes by the Fed, which the market is not fully anticipating. Most worrying is the large amount of rate cuts the market prices for next year (130bps) that may not eventuate if core inflation is slow to return to the 2% target.

4. Will China stimulate?

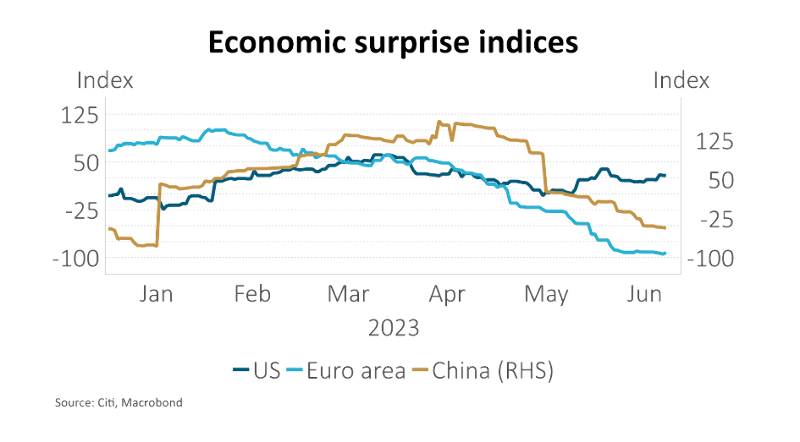

At the end of 2022, we identified an opportunity for investors if China was to re-open faster than anticipated. With a COVID-19 vaccine that proved to be more effective than many Western commentators believed, and strong government support for reopening, the Chinese economy delivered more than 2% growth in the first quarter of this year.

In Q2, however, Chinese growth has stalled. Real estate and consumption are the key areas of weakness. Real estate investment has fallen more than expected. New housing starts, property sales and house prices are dropping. For consumption, spending on goods and food has failed to sustain the growth seen in Q1. Economists have been making sizeable revisions to their growth forecasts for this year from around 6% to less than 5.5%.

It now falls to policy makers to determine whether the “around 5%” growth target this year will be beaten. Policy stimulus is likely to be multipronged, involving interest rate cuts, reductions in banks’ reserve requirements, lending to support infrastructure investment and targeted policies to activate consumer spending. There are no guarantees, however, as the government has increasingly shifted its focus to the quality of economic growth.

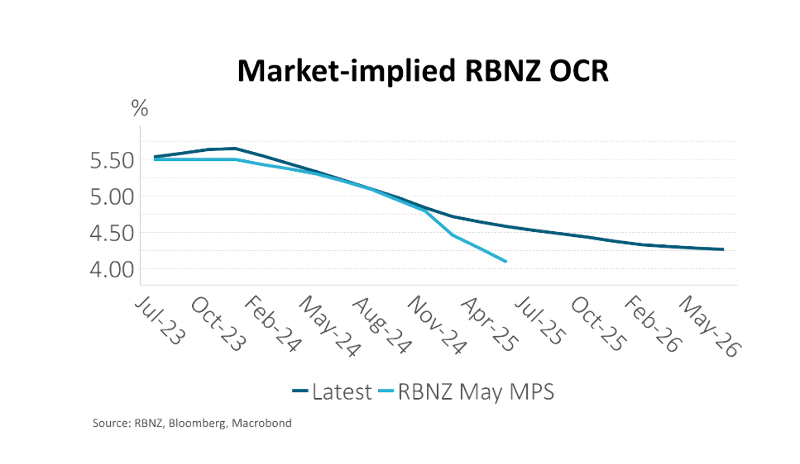

5. The New Zealand rates market is pricing a hawkish outlook, creating an opportunity for gains should inflation moderate

In contrast to the end of last year, where the New Zealand rates market was reluctant to accept a long period of tight monetary policy, it now prices a hawkish outlook that embodies the risk that inflation remains high. This has been partly driven by the recent migration surge, which is seen as adding more to demand than labour supply, and a less contractionary government Budget. The market implies a more than 50% chance of another 25bp hike by the RBNZ in October and incorporates just 80bp of cuts by the end of 2024, to an OCR level of 4.8% that is still highly restrictive.

There is evidence that monetary policy is working, however, and if this continues there is plenty of scope for short-term interest rates to fall. New Zealand is in technical recession. Inflation, on a quarterly basis, is dropping and taking inflation expectations with it. Job openings have fallen and are consistent with a rise in the unemployment rate. The housing market remains soft, and prices are well above the fair value implied by historical house price-to-income ratios and the percentage of income required to service a mortgage for a new buyer. The outlook for residential investment remains poor. Households are likely to continue reducing consumption and increasing savings as the economic outlook darkens and balance sheets lose value. The pain for mortgage holders isn’t over with 50% of outstanding mortgages still due to re-fix over the coming year.

Bonus Risk: Geopolitics. The tensions that can arise in the prevailing multi-polar world, where soft blocs of power exist without a single dominant player continue to be displayed. Recent events in Russia are an example of the instability and unpredictability markets and societies are dealing with. Market-moving events can be expected both within and across countries. It is tempting for investors to want to batten down the hatches in the face of this uncertainty. However, we would caution against taking this idea too far. It is certainly the case that some ongoing tension is widely anticipated, which implies that both upside and downside scenarios are possible. Perhaps the most useful approach is to keep locked into a longer-term investment strategy, while also preserving some liquidity and scope to take advantage of opportunities that arise.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

Comments

No comments yet.

Sign In to add your comment