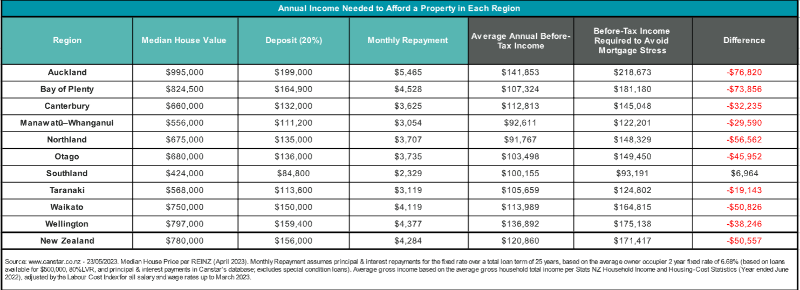

Canstar analysis shows that to be able to afford an average-priced $995,000 house with a 20% deposit, and repay the mortgage on current rates, households need nearly $80,000 more than the average income.

If households can’t meet that they will face mortgage stress or need a far bigger deposit.

Mortgage stress is generally defined as spending 30% or more of household income in servicing a mortgage.

The next most expensive geographical area - in terms of avoiding mortgage stress - is the Bay of Plenty.

Houses are selling, on average, for $824,500, and average household incomes are just over $107,000. However, to stay out of mortgage stress household incomes should be more than $180,000.

Canstar general manager Jose George says the analysis shows how tough it is in today's market to avoid mortgage stress.

“Paying more than 30% of the household income into a mortgage creates all sorts of other pressures, including being able to afford other bills and maintain general wellbeing.

“It is a really difficult situation to be in and our analysis suggests numerous families across New Zealand will be facing financial pain.”

George says the good news is it appears interest rate hikes are at or near the peak.

“Banks are likely going to be able to start borrowing money at cheaper rates, and in due course we'd expect that will flow on to consumers. But even before rates drop, consumers may find banks more willing to negotiate discounts or special offers.”

Comments

No comments yet.

Sign In to add your comment