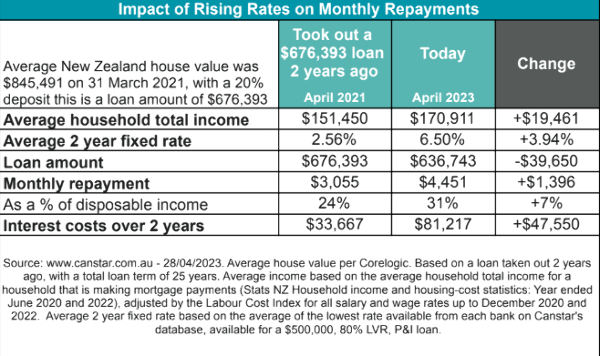

That means monthly borrowing costs have risen from $3,055 on the average two-year fixed term rate of 2.56% two years ago to $4,451 on the now average two year term of 6.5%. This is likely to sting a lot of homeowners.

Canstar’s analysis shows how the recent property market boom and rapidly rising interest rates have put new homeowners in an intense financial squeeze.

Research is based on figures showing the average house value at March 2021 was $845,491, which with a 20% deposit gave a loan of $676,393 over 25 years. Loan repayments were just under a quarter of the average household income. Higher monthly repayments now take 31% of the average household income.

These homeowners could now be under mortgage stress, says Canstar, as major lenders, including Westpac and ANZ, move to reassure customers who may be facing negative equity, or mortgage repayments higher than they were originally stress-tested on. Banks are encouraging them to reach out to discuss their finances.

Mortgage stress is defined as spending more than 30% of household income on a mortgage.

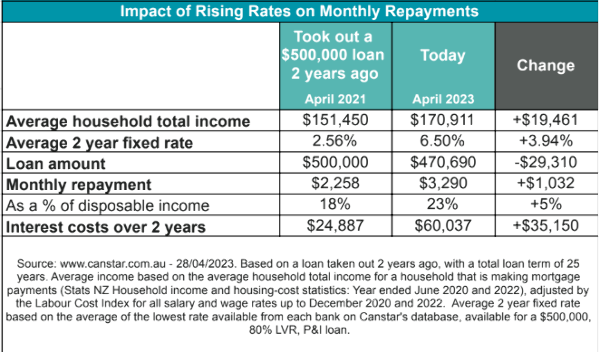

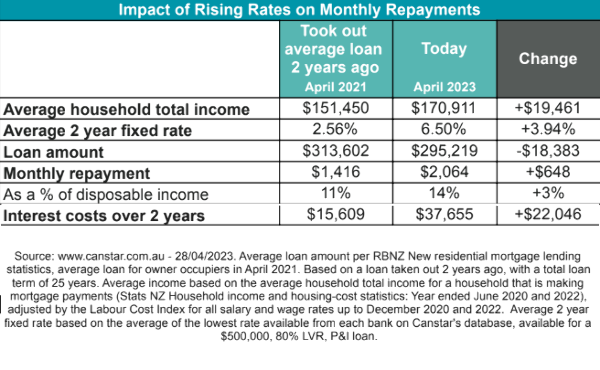

However, the impact on an individual borrower will vary significantly based on the loan.

The average rate (fixed and floating) paid on mortgage lending in March this year was 4.70% according to the RBNZ. But this remains well below what many will pay when their mortgages come up for refixing, which could be between 6.50-7%.

Canstar New Zealand general manager Jose George says it’s an incredibly difficult time for all New Zealanders, but even more so for those who bought homes during the boom times.

“The analysis shows how difficult rising mortgages can be to manage, particularly as other costs soar.

“We’ve seen a perfect storm of financial pain for those who purchased houses two years ago, when property prices were at their peak and interest rates were at a record low.”

Canstar’s George says talking to a mortgage adviser or bank and figuring out if there are ways to navigate this difficult period could help those who are struggling.

“It is important to front-foot financial stress, and find ways to manage the extra outgoings,” he says.

Mortgage advisers can advise whether there is risk of mortgage stress by calculating whether repayments will exceed 30% of their combined household income.

Canstar says it can be a good idea to test, in these calculations, if a client’s income is reduced or the interest rate on their loan is to rise.

However, working out if a client is in mortgage stress is a bit more complicated. It doesn’t take into account some benefits of paying more into a home loan, nor does it work for all income levels.

For example, a high-income household may choose to spend significantly more than 30% of household income on their mortgage and still have enough money to pay for other expenses.

Signs homeowners may be facing mortgage stress include, they live pay cheque to pay cheque and struggle to pay bills and their mortgage on time; they have recently lost their job or are facing redundancy; they have had to borrow money, take out a personal loan or use credit cards to cover ordinary expenses; their mortgage is interest only and they don’t have much equity in the property; and financial stress is impacting their personal life, mental health and/or relationships.

There are numerous ways to reduce payments to the minimum amount for struggling homeowners, including:

- reducing repayments to the minimum amount;

- accessing excess funds in the home loan. If a client has an offset account, it could be possible to use these extra funds for repayments. If the client has a redraw facility, it could be possible to withdraw some funds to cover repayments;

- asking for a repayment holiday;

- swapping to interest-only repayments;

- restructuring the loan such as by extending the loan period, or switching to a better interest rate; and

- refinancing with a new lender.

Comments

No comments yet.

Sign In to add your comment