By Greg Smith, Head of Retail at Devon Funds

The results season, which has wound down this month, was once again keenly watched. Markets had made a brisk start to the year in January on the prospect of better than feared outcomes in 2023. An array of results (and outlook statements) from companies covering a cross-section of industries was also going to be a useful sanity check on whether investors had gotten too far ahead of themselves (or not far enough) with respect to the broader market, and individual company valuations.

Further complexity was added to the mix with the advent of two extreme weather events. Some companies were clearly impacted more than others, and from a broader perspective there was also much ‘interest’ in how the floods and cyclone damage would influence the RBNZ’s decision on further rate hikes. In the end the central bank looked through the short-term financial impacts.

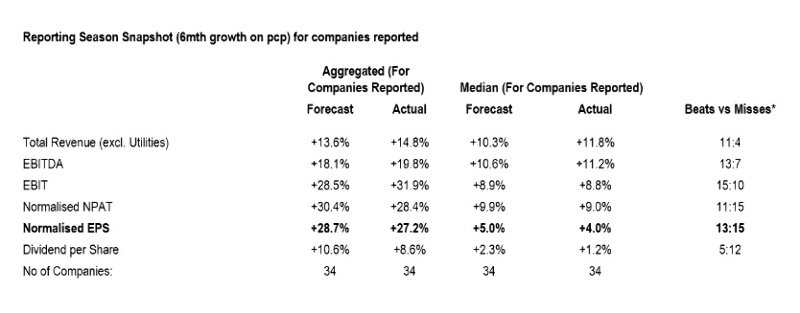

On the whole, it appears to us that the corporate results in NZ were ahead of expectations on a revenue basis. The number of beats exceeded misses by a substantial majority. Inflation is boosting the top line in many cases, as companies are seeing the same cost pressures that consumers are facing, but are looking to pass these on where they can. Underlying earnings surprised positively more often than not, with the ratio of beats to misses for EBITDA (earnings before interest, tax, depreciation and amortisation) registering a ratio of almost 2-to-1.

Source: Forsyth Barr [excludes WHS result 23.3.23]

At the bottom line it was a different story, with companies coming in with better-than-expected numbers, falling short of those coming out on the other side of the ledger. This can in some way be attributed to rising interest rates which are lifting corporate debt servicing costs. The latter remains a key area of focus for investors in this environment, with Ryman Healthcare’s recent capital raise a high-profile response to burgeoning debt levels.

With the world (and now China too) opening up at pace, a host of ’reopeners’ were in the spotlight. Amongst the earnings highlights was Auckland Airport. Profits have continued to recover, and guidance was lifted. Interim underlying earnings went back into the black, with a profit of $68m, and revenues more than doubled. January passenger numbers returned to 73% of pre-COVID levels. No dividends were paid but these could be back on deck in October. The airport could get a further boost as Chinese tourists and airlines in particular return and US services lift capacity. NZ has also been named as one of 20 countries open to Chinese travel agencies and tour operators. The Airport sees passengers returning to pre-Covid levels during 2025.

Air New Zealand also got back into the black, but half year pre-tax earnings of $299m was a massive turnaround from the $376m loss a year ago, albeit at the bottom end of guidance. Operating revenues soared 174%, with the recovery fuelled by a strong rebound in passenger numbers post Covid (8 million versus 3 million a year ago) and airfares. Domestic capacity is running at around 95% of pre-Covid levels, while international is at 60%. There is a milestone on the horizon for shareholder pay-outs – the airline will consider the resumption of dividends at their full-year results in August.

Also benefitting from the reopening has been Sky City Entertainment. The casino group reversed last year’s $33.7 million loss to a $22.9m net profit after tax. Half year revenues jumped 60% and are back at pre-Covid levels. Also back are dividends. FY23 earnings are tracking ahead of FY19 levels. Gaming machine revenues at the Auckland casino are powering ahead, at $156m for the half, compared to $139m in the same period just prior to the arrival of Covid.

Cruise ships are also back, including in the Bay of Plenty region, and Port of Tauranga’s result was another one of relative resilience with half year net profit up 11.3%. Container volumes ticked higher, and the Port expects full year earnings to be between $117 million and $124 million (the numbers contrast favourably with those from Ports of Auckland which expects a full year net profit after tax of $42-45m).

A2 Milk’s result (while since soured by Synlait’s guidance downgrade) was another solid one, with revenues and earnings both up around 20% for the period. China label Infant Formula sales rose 43.5% in the half year to December, an impressive effort as A2 continued to gain share in the Chinese market in the face of declining birth rates. Half year revenues hit $783m and the company seems on track to hit revenues of $2bn over the next 4-5 years. The company’s cash pile meanwhile remains robust, standing at $707m, which is helping to support share buybacks.

Fonterra reported that half year profits after tax jumped 50% to $546 million on strong dairy prices. The interim dividend was 10 cents per share alongside a forecast Farmgate Milk Price range of $8.20 - $8.80 per kgMS. The Co-op has also upgraded its full year forecast normalised earnings from 50-70 cents per share to 55-75 cents per share, and proposed a tax free capital return to farmer owners and unit holders of around 50 cents per share, subject to completion of the sale of the Chilean Soprole business. While milk powder prices have softened, flowing through to the forecast Farmgate Milk Price range, protein prices have been high. This has been reflected in the lift in earnings.

Away from the reopeners, there were also plenty of highlights. Freightways delivered, with a 25% surge in half year revenues and earnings growth of 8%. Express package volumes took off during Covid, but Freightways have maintained a steady performance here. The acquisition of Allied Express across the Tasman also appears to have worked out well, with the unit increasing its market share and improving its financial performance, despite taking on additional warehouse space to boost capacity for future growth. Freightways have noted the challenges of a tight labour market and is also cautious about the impact of a slowing economy, in NZ in particular. That said, the company also said it would continue to consider ‘complementary’ acquisition opportunities.

Healthcare company EBOS also came through with a good set of numbers. The distributor of healthcare and medical devices saw its underlying earnings (EBITDA) surge 39% while total revenues lifted 17%, and the company also lifted its interim dividend. The Animal Care segment performed strongly but the Community Pharmacy unit (includes the Chemist Warehouse and TWC) was the star of the show. Like Freightways, the company also suggested (having acquired LifeHealthCare last year) that it would be open to further acquisitions if the right opportunities presented themselves.

Results from the gentailers also highlighted the defensive attributes of the New Zealand market. Genesis Energy reported a 42% jump in earnings, with wet weather driving generation higher, with a record 2,034 GWh (giga watt hours) from the company’s three hydro schemes, up 43% on a year ago. Wet weather and better than average hydro inflows were also a tailwind for Meridian – those in the Waitaki catchment during winter were the highest on record. During this reporting period, Meridian also more than doubled the size of its renewable development pipeline of buildable options to 11,100 GWh.

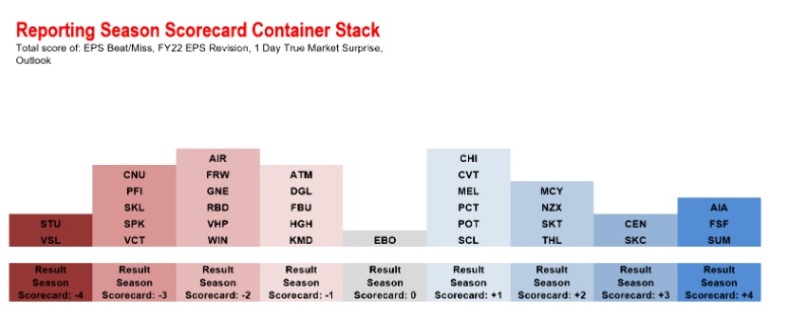

Source: Forsyth Barr

At the tail end of the season, this week has seen mixed results from two strong results from retail names.

Briscoe Group provided cause for cheer, after releasing a record full year result. Sales surged 5.6% to $785m, while net profits edged up 0.6% to $88.4m. The company is paying a final dividend of 16 cents per share. What belt tightening? The numbers from Briscoes bring further questions to the view that cost-of-living pressures and rising interest rates are seeing kiwis go into their spending shells. This is yet to happen in earnest, but there are certainly challenges on the horizon as acknowledged by MD Rod Duke. Briscoes however appears to have done a very good job to date of rising to various other challenges, including supply chain blockages. Margin pressures have been mitigated and the company’s investment in online (19% of sales) is paying off. Inventory levels have eased and Briscoes has $150m cash in the bank.

Results from Kathmandu owner, KMD brands, this week got a big tick from investors. Half year sales hit a record at $547.9 million, a 34.5% surged on a year ago, albeit a Covid impacted period. The company has been enjoying reopening tailwinds, doing well across the Tasman and also with the US boot brand Oboz. The company’s Rip Curl brand has also been riding the wave of rebounding tourism. It is the first time since the brand was acquired in late 2019 that the company has had a full year with without significant Covid interruptions. Overall earnings at KMD brands quadruped to $45.3 million with the company having notable success at lifting margins, and despite still regular periods of promotional activity.

There were some misses. The Warehouse delivered a weak result this week. Sales grew 4.8% to $1.8 billion, but against a Covid influenced comparative, with sales slowing down significantly in the second quarter (-4.6%). Gross profits fell 1.2% to $592.4 million, with margins declining due to “increased clearance activity.” Reported net profit after tax of $17.4m was down 60.9% on a year ago. A weaker than expected Xmas period also means the company could be sitting on more inventory than it needs, which may see further discounting. A net cash position of $150m has also turned to a net debt position of $83m.

Looking at the company’s divisions, the namesake Warehouse unit saw 13.2% growth in sales (helped by an expansion in the grocery category). Noel Leeming however is seeing the sugar rush enjoyed during the pandemic fade, as customers slowing their spending on big ticket items and ‘working from home products.’ Declining bike and fitness sales have impacted Torpedo7. The company has noted the uncertainty in the economic environment, and is not giving any guidance for the full year.

Cyclical industries also appear to be turning lower. Fletcher Building came out early with its first half year results, with revenues and earnings ticking higher, but the focus was on a downgrade to full year earnings guidance due to the adverse weather in January and February. The company also issued a somewhat downbeat forecast for the next year, with volumes in the company’s materials and distributions businesses expected to fall by 10-15%. This is due to softening residential markets in New Zealand and Australia. The cyclone-related damage that will need to be repaired or rebuilt may however be a silver lining for Fletchers.

In a similar vein Vulcan Steel fell sharply after the company reported a 3% fall in adjusted earnings to $115m for the first half. The numbers were however embellished by the performance of the company’s recently acquired Ullrich Aluminium business. Vulcan narrowed full year earnings guidance, but stripping out the acquisition, it would have been an earnings downgrade. The company said the second half was unlikely to improve materially across the NZ and Australian markets.

Overall, for all the uncertainty that continues to exist around the economic outlook, the earnings season gave some cause for comfort. ‘Resilience’ appears to be a common theme across the board, although less so in some sectors than others. Many high-quality names though remain in a strong place to withstand, and in some cases benefit, from any further twists and turns (problems in the banking sector being the latest) that the rest of 2023 may bring. This environment also remains a productive one for active, valuation-aware investors in our view.

Comments

No comments yet.

Sign In to add your comment