By Jamie Young

Artificial intelligence (AI) and chatbots are becoming increasingly popular in various industries, from customer service to healthcare and finance. These technologies allow businesses to automate and streamline their operations, providing customers with faster and more efficient service.

Chatbots, in particular use natural language processing to enable users to interact with them using conversational language, making them more user-friendly and intuitive.

One chatbot that has recently gained attention is ChatGPT, which uses a large language model trained by OpenAI to generate human-like responses to user inputs. ChatGPT is unique in that it can continue a conversation based on previous interactions, allowing for more natural and fluid conversations.

OpenAI is an artificial intelligence research laboratory. The company conducts research in the field of AI with the stated goal of promoting and developing friendly AI in a way that benefits humanity as a whole.

In this article, we highlight two questions I made to ChatGPT related to finance and one more off the wall example. We then muse on what this could mean for the future.

Question: Can you write a short essay on behavioural investing?

Response: Behavioural investing is an approach to investing that takes into account the psychological and emotional factors that can influence investors' decision-making. It recognises that people are not always rational and can be influenced by a variety of biases and emotions, such as overconfidence, herd behaviour, and loss aversion.

Unlike traditional investing, which is based on the assumption of rational decision-making, behavioural investing seeks to identify and overcome these biases in order to make more informed and profitable investment decisions.

One of the key insights of behavioural investing is that people are not always good at making decisions based on probabilities and statistics. For example, people tend to overweight the significance of recent events and underestimate the impact of long-term trends. This can lead to irrational decisions, such as selling stocks after a market crash or buying stocks after a big rally.

Behavioural investing also acknowledges that people are influenced by the opinions and actions of others, often leading to herd behaviour. For example, people may be more likely to invest in a certain stock if they see others doing the same, even if the investment does not make sense from a fundamental perspective.

In order to overcome these biases, behavioural investors may use a variety of techniques, such as setting investment goals, creating a plan, and sticking to it. They may also seek to diversify their portfolios and avoid overreacting to short-term events.

In conclusion, behavioural investing is a valuable approach to investing that can help investors make more informed and profitable decisions by recognising and overcoming psychological and emotional biases.

Question: Please write a debate on modern monetary theory between Howard Marks and Jim Cramer?

Response

Moderator: Welcome to tonight's debate on modern monetary theory, featuring Howard Marks, the co-founder of Oaktree Capital Management, and Jim Cramer, host of CNBC's "Mad Money." Tonight's topic is whether modern monetary theory is a viable approach to managing the economy.

Howard Marks: Good evening, Jim. I'm looking forward to an engaging debate on this important topic.

Jim Cramer: Hi, Howard. I'm excited to be here and share my thoughts on modern monetary theory.

Moderator: To start off, can each of you give a brief overview of your position on modern monetary theory?

Howard Marks: Sure, I'll start. In my view, modern monetary theory is a flawed and dangerous approach to managing the economy. It is based on the idea that governments can print unlimited amounts of money to pay for their spending without causing inflation or other negative consequences. This is simply not true. History has shown that excessive money printing leads to inflation and other economic problems, such as asset bubbles and financial instability.

Jim Cramer: I disagree, Howard. Modern monetary theory is a valuable tool for managing the economy in certain situations. It recognises that the traditional rules of economics do not always apply, particularly in times of crisis. For example, in a recession, when interest rates are already at or near zero, the government can use modern monetary theory to stimulate the economy by printing money and using it to fund public projects or provide relief to individuals and businesses. This can help jumpstart economic growth and prevent a further downturn.

Howard Marks: But that's just it, Jim. Printing money and using it to fund public projects or provide relief may provide a short-term boost to the economy, but it is not a sustainable solution. It will lead to inflation, which will erode the value of people's savings and purchasing power. It will also create asset bubbles, as people will be incentivised to invest in assets that are less affected by inflation, such as real estate and stocks. This can create financial instability and make the economy more vulnerable to future shocks.

Jim Cramer: I see your point, Howard, but I think you're underestimating the ability of the government to manage inflation and financial stability. Modern monetary theory is not just about printing money, it is also about using other tools, such as interest rates and regulations, to prevent inflation and asset bubbles from becoming a problem. In fact, many proponents of modern monetary theory argue that it can actually improve economic stability by giving the government more flexibility to respond to changing economic conditions.

Howard Marks: I understand what you're saying, Jim, but I still think modern monetary theory is a risky approach. It relies on the assumption that the government will always make the right decisions and use its tools effectively, but we know that this is not always the case. Governments are subject to the same biases and emotions as individuals, and they can make mistakes that have serious consequences for the economy. It's better to stick with proven economic principles, such as sound fiscal management and monetary policy, rather than relying on unproven theories that have the potential to do more harm than good.

Jim Cramer: I understand your concerns, Howard, but I think modern monetary theory is a valuable addition to the economic policy toolkit. It provides a different perspective on how to manage the economy and can help us avoid the mistakes of the past. It's not a perfect theory, and it should be used with caution, but I believe it has the potential to be a valuable tool in the right circumstances.

Moderator: Thank you both for a lively and informative debate on modern monetary theory. It's clear that there are strong arguments on both sides, and the decision

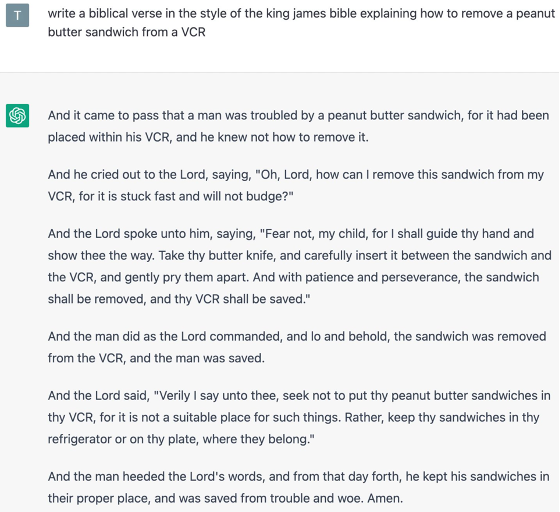

To take it more left field this was a request from one user:

How can you not be impressed by something that can write this well in mere seconds?

Where does this lead to? ChatGPT is currently “trained” up to 2021 so while it can’t yet incorporate recent events, the impacts are still truly immense:

- Education - how will teachers identify between student homework and AI-work?

- Content creation - how will we know what is written by human’s versus AI?

- Coding – AI can help debug programming code, what will this mean for jobs in the future?

You may be pondering the obvious question - how much of this article did I actually write vs ChatGPT? To make it easy, most of the AI writing is in italics, though as this article shows this may not be that easy to determine in the future.

See ChatGPT: Optimizing Language Models for Dialogue (openai.com) to try it out for yourself.

Comments

No comments yet.

Sign In to add your comment