By Stephen Bennie

Wishful thinking is not normally rewarded by the share market, mainly because it suggests a short-term investment horizon, and remember, great long-term returns from share markets do not require any wishes.

In the long-term the share market always delivers, so no wishful thinking is required. However, it is entirely understandable that after a year like 2022, investors are hoping for the next few weeks to see a Santa rally into Christmas to deliver investors a late but welcome share market boost.

It’s quite the understatement to say that 2022 has been tough, indeed for many of us 2022 is the year we became familiar with the phrase “omni-crisis”.

At times it was hard to imagine what else could possibly go wrong next, it’s been a veritable shopping list of bad news.

Rampant inflation, rocketing mortgage rates, war in Europe, lock down in China, Bitcoin collapse, UK Gilt meltdown, return of an Iranian nuclear threat and of course turmoil for bonds and equities.

It does appear that an inflection point for both news flow and sentiment may have finally been reached.

In the depths of share market negativity, no news is good news and bad news is the only real news anyone pays attention to. It doesn’t take much to imagine the recent events in the world cryptocurrency triggering broader risk off selling.

As dramatic failures go FTX ranks pretty high.

As recently as early this year the third largest cryptocurrency exchange, FTX founded by (former) billionaire Sam Bankman-Fried in 2019, was valued at US$32 billion. This month most institutional investors in the privately listed business were forced to re-value their investment down to zero, as FTX abruptly went into receivership.

Sam was suddenly bankrupt and fried with possible fraud charges heading his way.

The most interesting aspect of this new member of the “omni-crisis” was that it did not trigger the expected broader risk off selling.

Obviously, it caused Bitcoin to fall like a desk top computer dropped from a third-floor balcony, but it didn’t trigger selling in the broader share market.

Finally, an example of investors in 2022 feeling able to shrug of some bad news, a possible inflection point.

Then there was news of China starting to tweak its zero-Covid policy. Having the second largest economy in the world hampered by on-going virus related restrictions has not been helpful for the global economy.

While there remain significant restrictions to be removed, the recent news that the quarantine period for travellers was being reduced was a first step in the process of properly re-opening the Chinese economy.

And that process should see the “omni-crisis” list get a little shorter.

Another glimmer of positivity came from the United States mid-term elections.

There had been an expectation that voters would take the opportunity to rebuke the incumbent Democrat party. This expected rebuke would see Republicans take control of the Senate and the House of Congress leaving Biden as a lame duck president for the next two years.

However, the expected red wave did not arrive and while Republicans look to have taken control of the House, Democrats have retained the Senate.

This effectively avoids the lame duck president scenario which, regardless of your political leanings, wasn’t going to be a positive for the governance of the world’s largest economy. And the chances of Trump the President Part 2 coming our way in 2024 receded quite significantly, not a bad outcome either.

And then there was the most recent CPI print out of the United States.

Rampant inflation has been at the heart of this year’s “omni-crisis”. From January onwards these CPI readings have consistently surprised to the upside, sometimes shockingly so, which has triggered most central banks around the world, not just the US Federal Reserve, into raising cash rates faster and higher than anyone ever expected.

This has meant that investors have been unable to settle on what will be the level of cash rates that is ultimately needed to curb inflation, essentially this future terminal peak in cash rates has just kept going up. And that’s not good for investor sentiment.

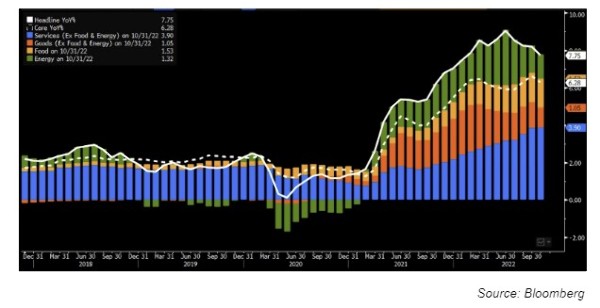

Chart suggesting that CPI may finally have topped out and is starting to drop back

However, a downward trend in inflation has emerged in recent months, as the chart above shows, which has allowed investors to believe that higher cash rates are finally starting to do their job of cooling inflation. The prior situation was akin to one where the brakes on a runaway train were just not slowing it down, even though the driver was cranking hard on them and was running of out of train tracks down the line.

Now, finally we are seeing the brakes starting to work and the runaway train slowing down.

That development allows investors to envisage central banks being able to slow the size and tempo of future increases to their cash rates.

Which brings us to Santa Pause, the notion that central banks might in the not-too-distant future be able to pause raising rates. This would open up the potential for 2023 to be “omni-better” than 2022 and that prospect could certainly help trigger a much wished for Santa rally. Indeed, it may have already started, the S&P500 just rallied by 5.5% in one day mainly on the back of these lower CPI readings.

Comments

No comments yet.

Sign In to add your comment