By Greg Smith, Head of Retail at Devon Funds

Needless to say, inflation has been front and centre of financial markets once again recently. The quarterly inflation print in NZ delivered a shock on the upside, coming in at 7.2%. This was down on the 7.3% in the June quarter, and while expectations were divergent, almost all expected a ‘6’ out front as opposed to a ‘7’. The market wasn’t exactly at “sixes and sevens” over the release - on the day the NZX50 underperformed many other global indices due to the much hotter than expected inflation print.

The market is now pricing in an 85% probability of a 75-basis point rate rise at the next RBNZ meet, with an even chance of a similar move in February. Forecasts for the terminal rate for the OCR (the max it will get to next year) have been lifted to 5.3%. The CPI rose 2.2% last quarter against the June quarter, driven by the food and housing group. Vegetable prices have risen the most on record. Petrol prices are falling, but tradeable (imported) inflation came in at 8.1%. This was lower than the 8.7% in June but was expected to fall further. Food for thought for the RBNZ.

Across the Tasman meanwhile the minutes from the last RBA meeting showed that the decision to side with a 25bps rise at the last meeting, was finely balanced. Officials were cognisant of the pace of rate hikes already put through and the impacts to the economy and property sector in particular. The RBA has acknowledged that the pivot to a smaller increase didn’t mean that the job around inflation was almost done, and suggested rates were rising into next year. Still the hints around the word “pivot” were significant.

Has the RBA though stolen a trick on other central banks in pivoting now? Data this week showed that Australia’s unemployment rate held at 3.5% in September. Job additions however missed, with just 9,000 jobs created during the month, versus the 25,000 expected. This adds credence to the RBA’s decision to side with just a 25bps hike at the last meet, and a moderation of rate tightening. Markets are now pricing in a 25bps rise in November.

In the US, the consumer price index print showed that core inflation increased 6.6% last month, the fastest pace since 1982. This has all but locked in a 75bps rise by the Federal Reserve next month. Stocks initially fell, then surged, and have been choppy since. Investors are continuing to grapple with a view on whether inflation has peaked or not. As does the consumer, although core US retail sales rose 0.4% last month.

Bond yields have also been moving around. The 10-year US Treasury has hit 4.23%, the highest level since June 2008. Higher priced growth stocks have continued to wear a high degree of the pain during the interest rate tightening phase this year, and on concerns of further increases in interest rates. Comments from Fed officials have not done too much to calm the farm.

Philadelphia Fed President Patrick Harker said this week that more interest rate increases will be needed, as previous hikes had shown little progress in curtailing inflation. He expects the Fed’s Fund Rate to be well over 4% by the end of the year. Fed Governor Lisa Cook noted that rates will need to keep rising to get inflation under control.

There are two more Fed meetings this year (1-2 November and 13-14 December). The market has priced in a rate hike of 75bps next month. Inflation remains the buzzword, but officials could well also pay some attention to the softening that has occurred in certain corners of the economy. Manufacturing in the Philadelphia region contracted more than expected in October, backing up a similarly weak read seen in the New York area which contracted in September, for the third month in the row. The state of the manufacturing sector in the US will be not lost on the Fed. The US manufacturing sector accounts for around 12% of the economy.

Existing home sales fell for the eighth month in a row in September, down 1.5% last month, and are down 24% annually, the steepest slowdown (excluding the start of the pandemic) in a decade. House prices are though still rising on a year ago, up 8%.

There have been plenty of warnings on the global outlook (including from certain bank execs, and Amazon’s Jeff Bezos) earlier in the week, but nonetheless the current state of affairs remains strong judging from the start of the earnings season. Early days but 80% of US companies have beat on earnings estimates thus far. This week we saw big blue chips IBM, telco giant AT&T, Lockheed Martin, Proctor & Gamble, insurance giant Travellers, and Netflix all beat on earnings. Tesla missed at the top line, but Elon Musk remained upbeat about the outlook, saying that he expects the EV maker to be worth more than Apple and Saudi Aramco combined down the track. Shooting for the stars.

A lot of pessimism has been priced into markets this year, and there has been significant conjecture about where interest rates, inflation and the broader economy are heading. Many data points have been ambiguous. While early days, the numbers coming from the earnings season thus far suggest that the level of pessimism has been excessive, particularly as it relates to the banking sector. JP Morgan Chase, Wells Fargo, Bancorp, Bank of America, United Airlines, and Bank of New York Mellon have all exceeded estimates.

This has been no coincidence, and while messages have varied over the outlook, and provisions have been upped, banking executives have all acknowledged that customers (and the economy) are in a good spot, at the moment.

US bank stocks have been very weak this year (some of the big banks shares prices are down around 30%), but this has been more on concern over the broader economic outlook. Banks are benefitting from higher interest rates, with the margin between lending and deposit rates expanding.

Overall, the six largest US banks are expected to set aside a combined US$4.5 billion in reserves for future credit losses. A year ago, credit provisions were being reduced as the worst fears around the pandemic failed to eventuate. Time will tell whether history repeats, and if a soft economic landing does eventuate, then these credit provisions may also be reversed to some degree. In the here and now, underlying profitability within the banking sector is clearly robust, driven by rising interest rates. The big US banks are provisioning for what “might be” in the future. In the here and now the general banking environment has proven resilient. Bank of America CEO Brian Moynihan said that banking customers have plenty of cash in the bank, and consumer credit remains “pristine.” Consumer balance sheets were fortified during the pandemic, and it seems customers have therefore been relatively immune to this year’s rising interest rates.

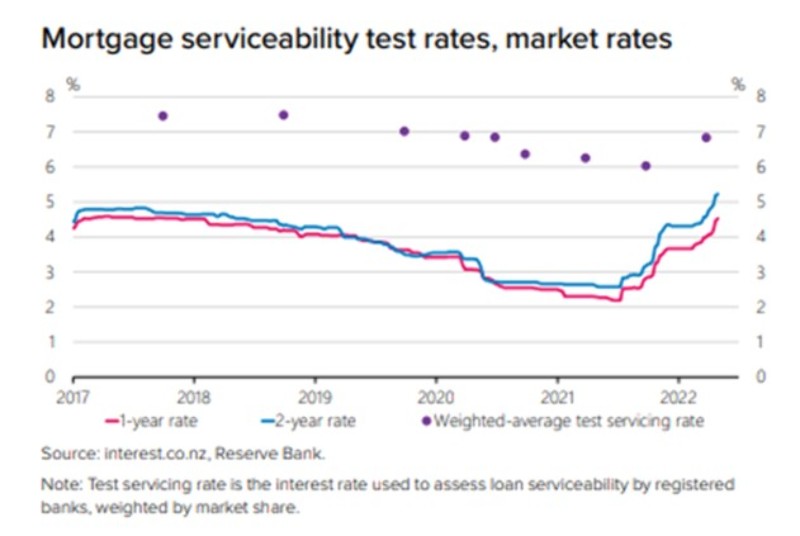

It is a similar story in NZ. Savings buffers have also increased significantly. Household saving increased to $2.1b in the June quarter after dropping to $230m in the first quarter of 2022. The decrease in household spending partly reflected reduced purchases of durable goods, such as second-hand cars and electronics. Kiwis are tightening their belts and battening down the hatches it seems, but this is also boosting the financial moat of New Zealand households. The net worth of New Zealand’s households fell 3.7%, or $88.9 in the June quarter, but at $2,347b is still some way ahead of the $2,048b it was at December 2020. This moat may now be needed for some and is being probed intently by the banks – which are now testing mortgage applications at interest rates greater than 8%.

As was the case in New Zealand this week, inflation prints globally have generally been moderating, but at the same time have been higher than expected. The UK inflation read was slightly different in these respects. The UK CPI rose to 10.1%, which matched the 40-year high in July, and was up on August’s 9.9%, but was broadly in line with forecasts of around 10%. Food and non-alcoholic drinks prices rose 14.6% in the year to September, the highest since April 1980.

Tricky times for the Bank of England which has increased interest rates seven times since December and a further hike is expected at its next meeting in early November. One central bank official said that it could take up to 10 years to unwind the emergency bond-buying program. Inflation is though not something that Liz Truss now needs to worry about as PM. A day after saying she was a “fighter not a quitter,” Liz Truss quit, with a 44-day term giving her the unwelcome accolade of the shortest serving British PM in history. Following the disastrous mini-budget and a popularity rating of just 10%, her resignation was somewhat inevitable. Former finance Minister Rishi Sunak is seen as one favourite to take over, but Boris Johnson is also seen as a serious contender. That would be quite the comeback.

The New Zealand economy meanwhile is receiving a boost from the reopening thematic. For tourists (particularly those from the US), the kiwi dollar continues to make the case for a visit here highly compelling, considering the FX rate was at 70 cents in March. It is a long way back, and this is good news for our tourism industry, with travel activity surging on the re-opening. This was evident from Auckland Airport which this week revised its guidance upwards for FY23 following a “stronger than expected rebound in the aviation market, with high aircraft load factors and continued strength in forward international seat capacity expected to fuel the ongoing recovery.”

AIA is now guiding for underlying profit after tax of between $100 million and $130 million for FY23, a big uplift on guidance provided in August of between $50 million and $100 million. Management noted that the first quarter saw strong travel demand within New Zealand as well as internationally, particularly in North and South American, South Pacific and Trans-Tasman routes. The airport noted the shape of the recovery was consistent with global travel trends.

Air New Zealand has been in demand of late. The airline sector is riding the crest of the global re-opening and are enjoying higher prices – Stats NZ reported that international airfares are up 20% over the past three months. A weaker NZ$ will also be attracting the tourists, particularly those on US dollars.

Air New Zealand has also caught the backdraft it seems from the standout result from Qantas. Shares in the Flying kangaroo have lifted off as Australia’s biggest airline delivered a very positive trading update. The company said it will be back in black by the end of December and expects half year underlying pre-tax profits of A$1.2 - $1.3 billion. Strong travel demand more than offset high levels of inflation and elevated fuel prices. This marks a huge financial U-turn for the company which reported a pre-tax loss of A$1.86 billion last financial year and has seen five consecutive pandemic-related halves with total losses of around A$7 billion.

The market was not prepared for such a bullish update. There has been a series of broker price target upgrades since. The guidance was more than double what was pencilled in by most analysts. Qantas now looks set to earn as much in the half year as the market was expecting in the full year. This has been a great result for the Devon funds, with the investment team taking a position in Qantas in advance of the results. Qantas is held in the Devon Alpha, Australian and Trans-Tasman fund.

Overall, the Devon funds have continued to navigate this year’s financial turbulence well. The Devon Trans-Tasman Fund was down just 1% in the 12 months to 30/9/22 and ranked in the top three within its peer group, and #2 (behind Devon Alpha) on a rolling 6-month basis. All the Devon Australasian funds are ranked in the top 10 on a 1-month, 6-month, 1-year, and 2-year basis. The Devon Alpha Fund was ranked #1 within its peer group for the funds covered by Morningstar to 30/9/22 on a rolling 6-month and 12-month basis.

Comments

No comments yet.

Sign In to add your comment