By Greg Smith, Head of Retail at Devon Funds

It comes after a significant period of market volatility in 2022, during which a significant amount of “bad news” was priced in during the first six months of the year. Markets rebounded in July and through much of August, but investors have been seeking some (localised at least) vindication that this has been justified, and an assessment of how companies are currently placed from a valuation perspective.

The earnings season has been important for a number of other reasons. With many commentators, analysts and economists talking up the prospects of a recession, there has been keen interest on the view from the coalface in terms of how the corporate sector is seeing the landscape. Investors have also been focused on the ability of corporates to protect their margins given still elevated levels of inflation.

There has also been more than a little interest in how companies that have benefitted from benefited from Covid are seeing things as pandemic tailwinds dissipate. On the other side are those companies that have done it tough during the past few years. Here the question of interest is how swift the recovery will be post Covid as the world normalises.

Results have in most cases also been impacted by factors other than Covid. The war in the Ukraine has exacerbated inflationary and supply challenges, while labour shortages have remained prevalent. Extreme weather has also been a factor for some companies. The impact of rising interest rates and softening property markets have also added to the mix. Political tensions, and global international economic concerns, particularly around China, has further muddied the waters, given China’s position as New Zealand’s largest customer.

Relevant again has also been just how well companies are coping with soaring inflation, and to what extent this has impacted earnings and margins. Alongside this, a primary question has been to what extent supply chain pressures (including the scarcity of labour) are easing, or whether there is any relief in sight.

This has left investors with a “lot to unpick” to try and make sense of results during the reporting period, and to seek clues about the outlook as trading conditions start to normalise to a degree (or not).

Broadly, the earnings season has shown that with markets still on edge about the economic landscape, disappointments have not been tolerated, particularly when valuations are elevated. Such situations have however been in the minority. Over the course of the reporting period the New Zealand stock market is roughly flat, and more reflective of offshore sentiment headwinds (particularly following Jerome Powell’s hawkish speech at Jackson Hole last week) than anything else. Indeed, arguably a better-than-feared reporting season has helped the kiwi market hold up better than many other global indices. The S&P500 for instance is down over 6% over the same period since mid-August.

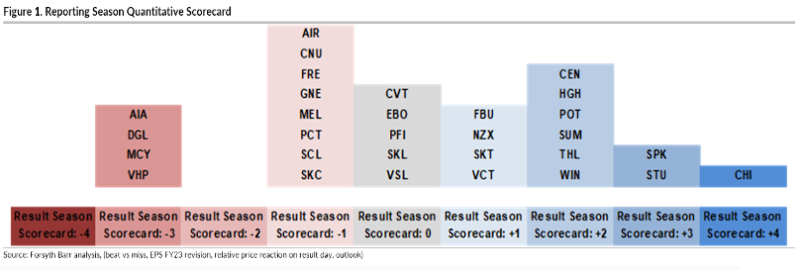

An interesting gauge of the generally positive nature of the reporting season is given by the below ‘quantitative scorecard’ from Forsyth Barr below. The scorecard factors in beats-to-misses, FY23 earnings per share revisions, relative price reactions on results day, along with outlook statements. The table is largely skewed towards the positive (right hand/blue) side of the ledger, showing that generally overall results outcomes have been positive. The quantitative scorecard overall is sitting at +6 points.

Results from the electricity companies were generally solid, with Contact kicking off proceedings. While reporting a 2.6% dip in profitability, investors were receptive to the news that underlying earnings are expected to increase to $720 million over the next four years. Strong renewable generation was a feature of the result as well, and is bolstering the outlook. Another positive was that the company announced it was in discussions with Tiwai about extending the contract at the smelter out past 2024. An extension would be positive for Contact (and Meridian) along with the NZ economy generally. Contact is held across the Devon funds.

The numbers and outlook were similar strong from Mercury NZ with wind generation providing a tailwind to earnings, along with a $367 million net gain on the sale of the Tilt Renewables shareholding. It was a transformative year for Mercury which also became the country’s largest retail supplier of electricity after buying Trustpower’s retail business. The metamorphosis potentially made for something of a “messy” result, but impressively Mercury continued a track record of growth in the dividend, which has now increased for 14 consecutive years. Genesis Energy also delivered a good rise in operating earnings and am upbeat outlook.

For the reopening stocks it was something of a mixed bag. Air New Zealand has come out with its Covid-impacted result, with a more than doubling of the full year loss. Revenues rose during the period, but expenses rose at an even faster clip, driven by labour costs, along with rising jet fuel prices. The release was titled “refuelled for recovery.” Moves in the oil price will be an interesting part of the dynamic going forward one would think.

The borders are open though which is a good thing. Auckland Airport reported that revenues rose 7% to $300.3 million while earnings were down 16% during a lockdown-impacted year as passenger numbers fell 13% to five million. Looking ahead the airport expects underlying profit after tax of between $50 million and $100 million for the 2023 financial year. Management are optimistic of a recovery in passenger volumes over the next 18 months, but are nonetheless being somewhat conservative in their outlook. The International Air Travel Association has meanwhile predicted that the global industry will recover to pre-pandemic levels in the 2024 calendar year.

Sky City released a result in line with guidance, with a number of positives. Capital expenditure is at historic lows, and the company is clearly enjoying much stronger operating conditions post the Covid restrictions. July and August were 110% of pre-Covid levels. The company is indicating that FY23 will be back to pre-Covid levels of profitability. Sky City is held across a number of the Devon funds.

While reopeners have clearly been challenged substantially by the pandemic, the likes of Skellerup have thrived. The rubber boots and gloves manufacturer announced a record net profit after tax of $47.8 million for the year ended 30 June 2022, a 19% increase over the previous record result. Revenues were some 13% higher at $316.8 million. The company’s industrial division was a standout, with earnings up by 20% to $39.1 million. Sales into “potable water, wastewater and high-performance foam” have been going gangbusters.

Another to come in with a solid result was Precinct Properties with net operating profit before tax of $95.3 million, up 14.8% on the year previous. The company delivered a strong leasing performance, and the quality of Precinct’s assets are evidenced in an occupancy rate of 99% over the year. The average lease term is 7.1 years, and the company has a number of developments on the go. Management cited some $854 million of value-add development projects currently underway with 77% pre-leased to quality occupiers. Precinct has also brought a high-quality partner into the fold, with an investment partnership with Singapore sovereign wealth fund GIC, which was announced in February.

Results out of the telco sector were robust. Spark New Zealand was a star, reporting a 7.6% lift in profits, with the mobile business the standout. The performance was all the more impressive given that roaming revenues were suppressed during the period due to closed borders. The highlight of the result was growth in the dividend. Spark plans to lift it to 27cps in the 2023 June year. This is good news for yield seeking investors. Spark is held in the Devon Dividend Yield Fund, as well as across many of the other Devon funds.

A much-anticipated capital return was also announced following the $900m sale of the TowerCo assets. Spark is returning up to $350 million to shareholders through an on-market buyback. Around $350m is being held for growth initiatives, while the remaining $200m will be used to pay down debt to support an investment grade credit rating – the tower sale is effectively a sale and leaseback transaction.

Chorus meanwhile reported that earnings before interest and tax rose to $248 million from $230 million a year ago. Revenues ticked up $10 million to $965 million. Having rolled out ultra-fast broadband to 87% of the population, a period of heavy capital expenditure is behind Chorus. The company is now earning more than it invests in the network and is following through with cash returns to shareholders. The company increased its FY23 dividend guidance.

EBOS also came in with a great result. The medical supplies and animal healthcare company reported a 21.3% lift in underlying profit after tax to a record A$228.2m. The final dividend declared was 49cps. EBOS is actually in its 100th year of operation, but continues to evolve as a business, completing five acquisitions during the period. The largest of these was LifeHealthcare, which has made EBOS one of the largest independent medical device players in Australasia. The acquisition is performing in line with expectations. The group outlook appears strong, with EBOS anticipating another year of profitable growth in 2023.

Fletcher Building rose post its results. Investors have moved on from the gib saga, and the results showed that the company is producing materials as fast as it possibly can, and indeed looking to build further capacity. Net profit for the year surged 42% to $432 million, on revenues which rose 5% to $8.5 billion. Earnings before interest and tax came in at $756m, slightly ahead of the company’s $750m guidance. Margins rose to 8.9%, highlighting the company’s pricing power in an inflationary environment. Looking ahead the company wants to beat the 2022 earnings result this year by more than $100 million.

One of the leading performers in the earnings season was Freightways. The express packaging company reported a 9% lift in annual revenues and revealed an acquisition across the Tasman which will allow the company to enter the Australian market “at scale.” Freightways is also displaying pricing power, and has been passing on input cost rises to customers through higher prices. The stock is held in a number of the Devon funds.

Another company held across the Devon funds is Port of Tauranga which reported that full year revenues rose 10.9% while net profits gained 8.7%. The company upped the dividend. It was a stellar performance for the port given ongoing supply disruptions. Management noted that 65% of all vessels have delivered off schedule. Ship visits are recovering and rose 4.7% to 1,369. Tauranga’s competitive strength is that it can handle bigger ships. It is a pity however that red tape is getting in the way of additional capacity, with the consent process for the berth extension taking some time to work through.

In terms of results reactions, one of the best was saved for last. There was relief at results from A2 Milk with the infant milk formula company reporting a 42% surge in net profit, with the company’s key Chinese business performing much better than expected, despite an ongoing decline in birth rates in the country. Revenues jumped nearly 20% and the company announced a big share buyback. A2 is positive about the outlook for 2023 with high single-digit revenue growth and margin improvement expected going forward. The shares rose but have had a torrid time of it over the past couple of years.

Two notable absentees from the results season were Mainfreight and Fisher & Paykel, both of which have March balance dates. Fisher & Paykel Healthcare did however issue a guidance downgrade, forecasting a half-year profit between $85m and $95m to the end of September against the $222m achieved last year. Revenue is expected to drop to around $670m from $900m. Fisher & Paykel Healthcare has been a huge pandemic beneficiary, but the tailwinds are starting to fade with vaccines and Covid having morphed into more benign variants. Hospitalisation rates, and the duration of stays, have fallen substantially as a result.

Hospitals also increased their ventilator stocks in anticipation of Covid waves. The company as a result sold 10 years' worth of hardware in the first two years of the pandemic. High freight costs have also chipped away at margins. Sales are still above pre-pandemic levels (by around $100 million), but investors are now looking to determine what the company’s long-term earnings profile looks like.

Overall though, the New Zealand earnings season has proven much better than feared. Despite rising interest rates, and elevated levels of inflation, corporate New Zealand still appears to be in good shape. Companies with strong, defensive business models, and robust pricing power appear to be doing the best, but there are also many companies which are leveraged to the ongoing reopening of the global economy. A weak currency has also been supportive for our exporters. Many companies are sharing the spoils with shareholders, through higher dividends and buybacks. It is also saying something that the share of weight of positive results was enough to overshadow negative sentiment drivers from offshore, including a hawkish Fed. What recession?

Comments

No comments yet.

Sign In to add your comment