Resimac general manager New Zealand, Luke Jackson, says the campaign it designed to raise awareness that the company is a specialist property lender.

He says raising awareness will also help advisers when they put a Resimac solution in front of a customer.

“The new campaign will benefit brokers and advisers dramatically by making Resimac more recognisable to everyday consumers," he says.

"Our goal is to make it known that we are residential property lending specialists whose sole purpose is to ultimately help people purchase properties. By treating customers as individuals and building mortgages around their needs, we are a very different breed to the traditional financial institutions.”

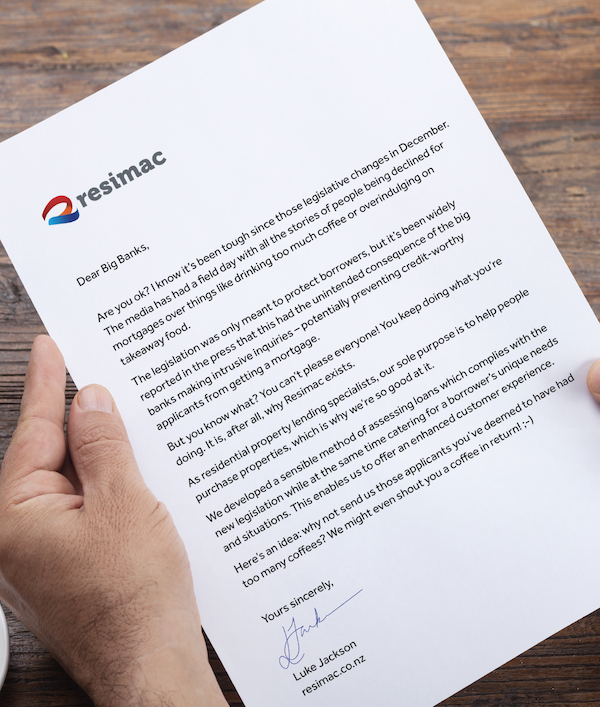

The ad campaign features an open letter (see below) to the big banks about the CCCFA changes, published in leading broadsheet newspapers, and will be supported by radio ads and a promotion across major national radio networks. The campaign will also be run as extensive digital display ads across digital networks and social media.

“We appreciate that it can be challenging for brokers and advisers to educate their customers about lenders other than the banks, with alternate lenders only representing a fraction of the market and lacking the brand recognition of the majors.

“This campaign will help change that by creating greater brand awareness and educating customers on Resimac’s value proposition. As residential property lending specialists, we’re not distracted by other products and services like insurance, credit cards and savings accounts offered by many financial institutions," Jackson says.

"Instead, we’re able to focus exclusively on home loans to the benefit of our customers, helping them to ‘win at property’.

“This single-minded focus means we’re able to offer great products, including mainstream prime mortgages, at competitive rates paired with an efficient and dedicated service. It also allows us to be agile and responsive to market, regulatory and consumer changes, enabling us to deliver customer-centric products and services ahead of the curve.

“Plus, with variable now becoming the cheaper rate option in the current lending environment, we anticipate more customers being open to alternate lenders. That makes this campaign perfectly timed to capitalise on a greater appetite for a property lending specialist like Resimac, which also makes the jobs of our broker and adviser partners that little bit easier when it comes to recommending suitable mortgage products,” Jackson said.

Comments

No comments yet.

Sign In to add your comment