We are appalled and saddened by the humanitarian disaster unfolding in Ukraine. Our hearts and thoughts are with all those people who are suffering. Our investment team is actively monitoring the situation and the implications for our clients’ portfolios.

We can confirm that no Harbour fund has any specific stock exposure in Russia. Our compliance system has also been coded to ensure no Russian securities can be added.

Key points

- The MSCI All Country World (global shares) Index fell -2.5% in NZD hedged terms in February and, with the New Zealand dollar strengthening in the past month, the same Index fell -5.5% in NZD terms over the month.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 0.75%, whilst the Australian equity market (S&P ASX 200) rose 2.1% in both AUD and NZD terms.

- The Reserve Bank of New Zealand (RBNZ) delivered a hawkish statement along with a 25bp hike to 1.00% in February, retaining the option to move in 50bp increments and revising its OCR forecasts higher than implied by market pricing.

- Russia’s invasion of Ukraine has become a humanitarian disaster. The geopolitical environment is now vastly changed with a wide range of potential outcomes. It has also added further upward pressure to global energy prices and inflation.

Key developments

Global equity markets ended the month lower. Long term interest rate increases and escalating geopolitical tensions contributed to volatility. Equity markets strengthened into month end with central bank rate hike expectations wound back as military action raised the risk of slower economic growth. Production disruption and Russian sanction constraints contributed to a further increase in commodity prices with the price of oil increasing another 7.5% over the month.

New Zealand and Australian equity markets were more resilient, both delivering positive returns in February. The performance of the New Zealand market was driven by a reporting season which, in aggregate, delivered results above consensus analyst expectations. This was most notable in announcements in electricity generation/retailing companies. The strength in the Australian market was driven by strong commodity prices which led the energy and resources sectors higher.

Russia’s invasion of Ukraine has added further upward pressure to global energy prices and inflation. Since the invasion began on 24 February, supply concerns have seen European natural gas prices more than double and Brent crude oil prices increase 20%. About 20% of Europe’s natural gas supply flows through the Ukraine. Russia is the world’s second largest crude oil exporter and there is a fear that Western sanctions may disrupt this source of global supply. Higher energy prices and lower consumer confidence are likely to weigh on economic activity, particularly in Europe. As the crisis has evolved, commentators are unearthing broader and deeper economic consequences, from the global supply of wheat and certain minerals to stress within the financial system.

The global central bank response to the Ukraine crisis has varied but given high inflation and low unemployment, policy normalisation is likely to continue in most countries. European Central Bank officials have indicated the crisis is likely to need a more careful approach to removing stimulus and markets now price just 20bp of tightening by the end of this year, from almost 40bp prior to the conflict. The US Federal Reserve (Fed), however, looks set to begin pushing rates higher this month given more acute capacity pressures. Financial markets price 5-6 Fed rate hikes over the next year, about one hike less than prior to the conflict. Other central banks generally remain on a path of monetary policy normalisation from extremely easy settings. China remains the exception by incrementally easing policy recently in response to a slowing economy and property sector weakness.

What to watch

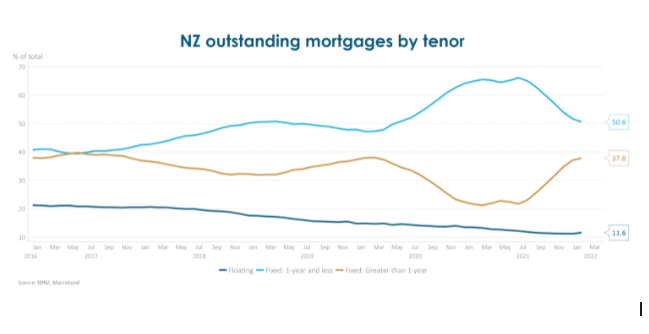

House prices: As it stands, we struggle to see the OCR reaching the RBNZ’s forecast of 3.4% as we see headwinds to economic growth. Among these are house prices, which are down 1.4% in the past two months. We think they are likely to fall further in response to higher mortgage rates and the plethora of other challenges. 1-year mortgage rates are 160bp higher than the lows of last year and the mortgage curve implies these will be the best part of 5% by year end. 50% of outstanding mortgages are due to refix over the next year. For a homeowner paying off a mortgage over 25 years, every 100bp increase in mortgage rates will increase repayments by 11%.

Market outlook and positioning

To quote US politician Donald Rumsfeld, ‘there are known knowns … and there are known unknowns’, a concept that is continuously factored into stock markets. In our view stock market ‘clouds’ in the form of central bank rate hikes and the potential (now a reality) for a war in Europe that have been hitting stock market returns will lift over time. But, in the near term, investors are likely to continue to face a noisy, volatile period. Short term, the investment environment remains harder than normal to predict.

Capital markets’ ‘warp speed’ pricing of monetary policy tightening plus commodity price shocks have the potential to create a growth scare. Leading economic indicators, both locally and globally, are highlighting the potential for the rate of economic growth to slow following the sharp re-opening/quantitative easing-boosted recovery of the past year. We are past the low point in interest rates cycles but a rapid slowing in lead economic indicators may slow the recent rapid increase in long term maturity bond yields. But with inflation risks increasing, central banks will need to continue to lift official cash rates. Markets have moved to price in a +0.25% rate hike by the Fed in March, which is down from a +0.5% rate hike before the conflict started. Futures markets are still implying an 80% plus probability of a 1-1.5% increase in the Fed rate from now until the end of calendar year 2022.

At an overall level, we think equity prices have largely adjusted to the move in bond yields. Our indicators of the relationship between forward price-to-earnings (PE) multiples and bond yields are approximately within historic boundaries. We see this relationship at a market level and for many individual securities. As a result, to the extent that the equity risk premia are now elevated to consider geopolitical risk, they could eventually be a buying signal for longer-term investors. However, volatility in equity markets will continue. And it will be hard to unravel volatility associated with interest rate expectations and the bond market, with geopolitical risk. We think that the prospect of a global recession in the next 12 months is low. The New York Fed model and other indicators do not show economic stress or bear market financial stresses. A policy overstep (potentially in New Zealand) is a risk, and worth monitoring.

Within equity growth portfolios, we have not made any direct changes to the portfolio due to the Ukrainian conflict. The opportunities to increase positions in Macquarie Bank, Meridian and Contact, and the healthcare sector (CSL and Ebos) arrived through market weakness. All these companies had excellent earnings reports; hence the decision-making was already largely in place to increase the positions. Within portfolios we have investments in diversified commodity producer BHP and copper producer OZ Minerals reflecting near-term tightness of supply that existed before the conflict, with both stocks supported by longer-term economic de-carbonisation which needs copper, nickel and aluminium. More broadly, we are directing our stock research into understanding the longer-term implications of de-globalisation, the need for supply chain changes and the ability of businesses to pass on higher prices. Over the longer term, the conflict probably accelerates larger structural trends especially accelerating de-globalisation and investment in renewables in Europe.

Within fixed interest portfolios, we are increasingly questioning how quickly rate hikes might slow activity and to what extent tight monetary policy is appropriate to fight inflation when much of the price rises occurring are beyond the control of the RBNZ. Market rates lifted after the Monetary Policy Statement and currently anticipate the OCR rising to 3.3%.. Our assessment of the outlook was reviewed at our strategy meeting in late February, and we have added duration as well as exposure to inflation-indexed bonds. We acknowledge that the RBNZ is openly discussing the possibility of 50 basis point hikes but, as discussed above, see reasons why this may not happen. The Ukraine situation alone should give pause for thought in the near term.

Within the Active Growth Fund, we have built up our position in real assets over the past couple of months. One of the strategies we have increased allocation to is our Real Estate Investment Fund. Real estate securities are currently trading at an attractive dividend yield spread to bond yields, are typically able to reclaim inflation in their rents, are trading at fair valuations, and we see scope for M&A within the sector. We like infrastructure for similar reasons. We have added to a small position in T. Rowe Price’s Asia ex-Japan Fund, which has weathered the volatility so far in 2022. We view Asia as one of the undervalued parts of the markets with scope for upside. The drivers we see of this upside in 2022 are the Chinese Government easing policy (when the rest of the world is tightening), valuations compared to developed markets are extremely cheap and, unlike 2021, where policymakers were focused on reform, attention appears to have moved on somewhat.

Within the Income Fund, we have reduced equity exposure, both with regards to exposure to growth-focused equities and to European equities. This has taken effective exposure to just under 30%. In the fixed income area, we have added to inflation-indexed bond exposure and made modest reductions to the BBB credit sector, where there is some risk of underperformance.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

Comments

No comments yet.

Sign In to add your comment