Along with most experts, the bank had been forecasting the Official Cash Rate to plateau at about 2%.

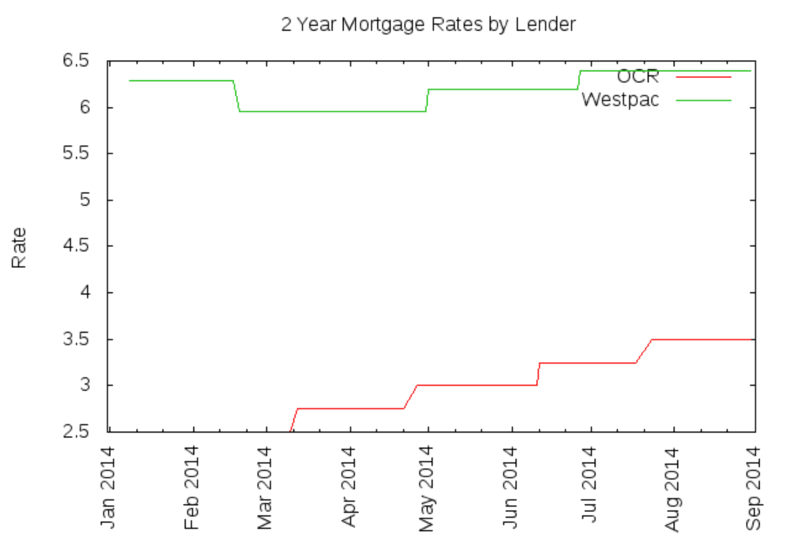

The last time the OCR was at this level Westpac's two-year fixed rate sat at 6% (see graph).

But Westpac now thinks a 2% OCR would not be enough to rein in inflationary pressures.

Its view has been affected by a record-equalling low of 3.4% unemployment, which it says is bound to push up wages.

The bank adds the Official Cash Rate peak of 3% will happen by mid-2023.

It says while that wouldn’t be particularly high compared with long term history, it would be a significant unwinding of the economic stimulus that was put in place in response to Covid-19.

It adds the OCR is unlikely to come back to 2% before 2025.

Westpac goes on to say there is a chance the RBNZ might abandon its practice of 25 basis point jumps in the OCR in favour of a much bigger leap of 50 basis points, each time it makes a move.

Comments

No comments yet.

Sign In to add your comment