The Financial Markets Authority's (FMA) director of market engagement and acting director of regulation John Botica says he's pleased with the numbers so far but after just six months under the new regime it would be hard to identify any trends.

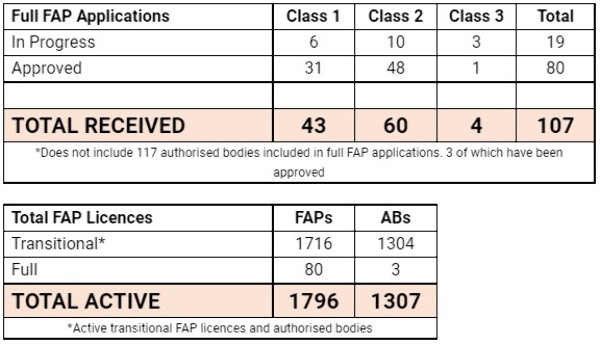

As of yesterday morning, a total of 80 Financial Advice Provider (FAP) licences had been approved by the FMA across all three licence classes with another 19 in progress (see chart below).

"But what I'm impressed with is when we have been getting out and talking to advisers across the country is that a lot of them are thinking about what their business will look like in the future."

Botica says roughly 60% of applications are for Class 2 licences for businesses with between two and 10 advisers whereas in March about 50% of transitional licences were for single adviser businesses.

"They are looking forward at their structures, some may be retiring and succession planning and some may be looking at buying another advice business in future."

Botica says the initial fear of the new advice regime is fading and "...the more questions we get asked helps us to refine our material and application process".

"The first hurdle may have been the fear of the unknown but the application process is straightforward, but you do need to prepare and get your ducks in a row.

"I think there's a much better understanding of the process among advisers now."

Botica says what has been consistent is the total number of advisers in the market and "...we know there were some advisers who applied for a FAP but are now authorised bodies, so some of the numbers are slowly moving around as advisers think of their business structures.

He says turnaround times for applications can change depending on information received and the number of applications at one time, but some have been processed within a few weeks.

"We have set a standard of 60 working days for each one, but we are coming in a lot faster than that right now."

He says the FMA's website is packed with information for advisers who can also park an application once it's been started to complete at a later date.

The FMA can't access partial applications and will only act once a full application has been received.

The FMA's principal consultant for market engagement Derek Grantham says the FMA is working with advisers and firms to make sure they understand the process and what type of license they should be applying for.

"It also means reflecting on what you have learnt over the past six months, and what you think the future will look like for your business.

"One of the first big decisions you need to make is which type of FAP full licence is right for you, as this determines some of the things you need to think about now, and have in place, in support of your full licence application," Grantham says.

For more information about what licence class to apply for, click here.