Lakeside towns Queenstown and Wānaka are drawcards for adrenalin thrills, spectacular scenery and luxury style ... but they couldn’t be more different.

Queenstown is the brash resort town, until recently attracting millions of international visitors wanting world-class activities and luxury accommodation. Wānaka is a quieter, less commercial, laid-back lifestyle town.

Queenstown became the first mover in tourism, pioneering activities like the South Island’s first commercial ski area, Coronet Peak, in 1947; the world’s first commercial jet boat operator KJet in 1958; Skyline Queenstown Gondola in 1967; commercial bungy jumping in 1988 and many more ventures.

Pre-Covid, at certain points of the year, Queenstown had 34 international visitors for every local resident and 55% of the town’s GDP came from tourism.

Wānaka quietly followed suit, introducing world-class activities of its own but attracting a different type of visitor. And in recent years different types of residents, including families seeking a quieter pace with a more personal touch; and entrepreneurs looking for the lifestyle while building businesses – diversifying away from the tourism industry.

Now the flood of visitors in both towns has slowed to a trickle. Queenstown is struggling to get back on its feet and two distinct economies have cut into its fabric – the tourism-based industries that are operating under extremely adverse trading conditions and the rest, which appear to be operating at near normal activity levels.

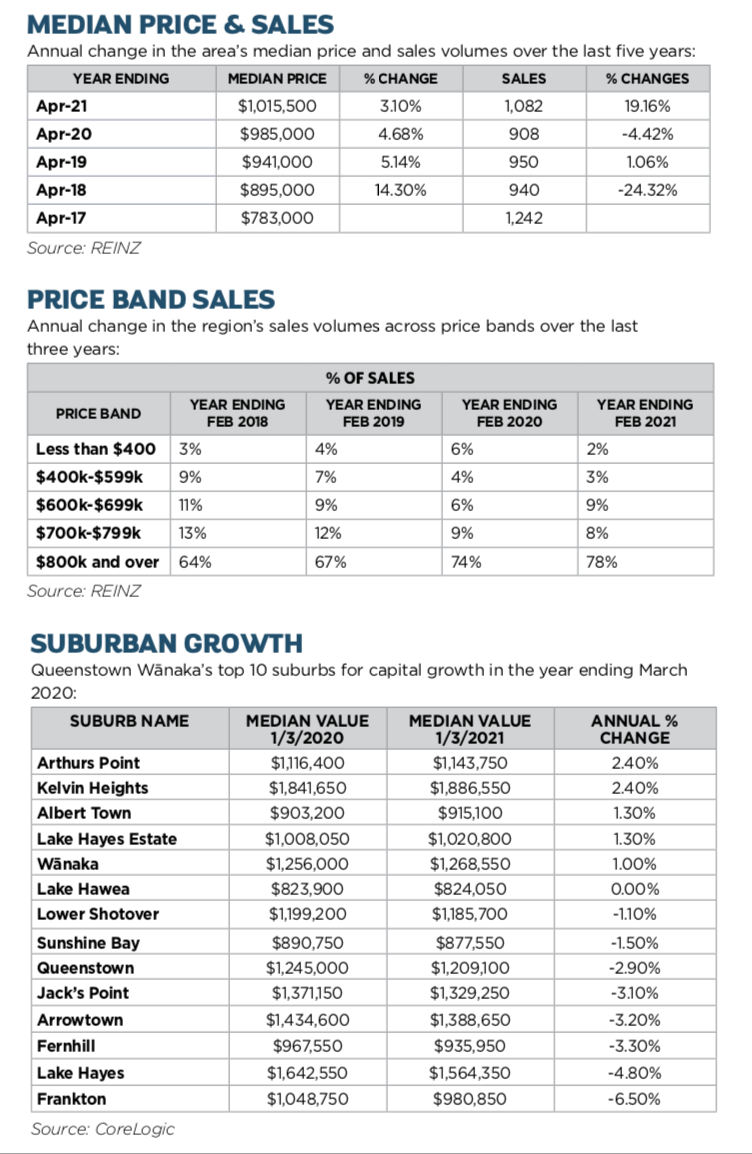

However, growth in Queenstown- Lakes District house prices has been a bright spot in a dreadful year. The latest REINZ data shows the Queenstown- Lakes District reached a new record median house price of $1.2 million in April 2021, up 41.2% from $850,000 in April 2020.

OVERSEAS BUYERS HELP

While the housing market has stabilised Queenstown and Wānaka are still among the most expensive places in the country to buy. CoreLogic data shows only five of Queenstown-Lakes District’s 15 top suburbs experienced house price growth over the year till March 1 and prices fell for the rest.

Arthurs Point, Kelvin Heights, Albert Town, Lake Hayes Estate and Wānaka increased from 1% to 2.4% while Lake Hawea remained static. Frankton, Lake Hayes, Fernhill, Arrowtown, Jack’s Point, Queenstown, Sunshine Bay and Lower Shotover dropped in value from 1.1% to 6.5%.

Increasing values were led by Arthurs Point with a year-on-year rise of 2.4% to $1.143 million from $1.116 million at the beginning of March last year. Also with the same year-on-year increase is Kelvin Heights increasing to $1.886 million from $1.841.

At the other end of the scale Frankton dipped 6.5% to $980,850 from $1.048 million, while Lake Hayes dropped 4.8% to $1.564 million from $1.642 million.

Harcourts Otago managing director Warwick Osborne says investors make up a heavy proportion of Queenstown’s properties. “There is strong demand from mainly Auckland and Wellington investors and to an extent Australians. Since Covid struck, there has been high demand as people’s lives pivoted and they took a different time horizon. Covid has been the catalyst for both Queenstown and Wānaka to become lifestyle districts and more people are starting businesses outside tourism.”

Investors are mainly interested in Hanley’s Farm and Jack’s Point as well as vacant land as long-term holds. “The upside of investing in Queenstown land is much of it is zoned high density but the town is constrained by supply and its geography,” says Osborne.

Investors’ sweet spot for buying can be any price as long as the fundamentals of the property meet their criteria and there is a cashflow, he says. They generally target two-bedroom, two-bathroom houses or the home and income properties built in the new suburbs.

Wānaka is short of listings and has a “Kiwi-centric” appeal with strong demand from Auckland and North Island buyers attracted by the town’s spectacular lakeside location.

Osborne says investors across the board in both towns want a property with a lake view expecting it will lead to capital growth.

He says a small minority of investors will sell their properties if seasonal workers are not back in the town in the next few months, but most are long-term holders and stay because of the lifestyle and beauty of both towns.

SIGNIFICANT CHANGES

Since tourism dried up during the first Covid-19 lockdown in March last year and hasn’t recovered, Queenstown’s rental market has changed dramatically.

From a serious shortage of rentals pre-Covid, there is now a surplus that is not moving. Many older properties in Fernhill and Sunshine Bay that rented for $1,000 a week to seasonal hospitality workers are lying empty and are not renting at all. Many have been empty since March last year.

Long-term Queenstown renters are also moving away from these more traditional rental areas to new properties at Hanley’s Farm and Jack’s Point where a contemporary, well insulated family home can be rented for about the same price as houses in the older suburbs.

Richard Hoskin general manager of the Queenstown Accommodation Centre, the biggest rental agency in Queenstown, says rents are stagnant.

“They dropped by up to 25% when Covid-19 hit and haven’t moved at all since.” Hoskin says they won’t increase until there are more tourists’ feet on the ground and business owners can start hiring staff, who will then look for somewhere to rent.

Some of the older houses are more affordable for seasonal workers as they have five and six bedrooms, whereas families are keen on three to four- bedroom homes in the newer areas.

The Queenstown Accommodation Centre has 800 rentals on its books – 80% in Queenstown and the rest in Wānaka. Hoskin says some investors are choosing to sell their older properties and others are giving their properties significant makeovers to meet the new Healthy Homes’ regulations and RTA rules. “Until there are more people visiting Queenstown’s cafes, bars, restaurants and attractions they could, however, remain empty,” says Hoskin.

Families and young professionals are renting two to three-bedroom homes for $550-$850 at Hanley’s Farm and Jack’s Point, where there are more apartments, a two-bedroom new unit will rent for $700 a week.

While there are more new apartments coming on to the market, Hoskin says there will not be an oversupply with only half being bought by investors for rentals.

SEASONAL SHORTAGE

In Wānaka Covid-19 hit rents for the first few weeks and they dropped 20% but they are creeping up to more normal levels as renters can afford it.

About 90% of Wānaka’s stock is long- term rentals. They rent on average at $650 for a two-bedroom, two-bathroom home; $575-$625 for a three-bedroom, two-bathroom house; and $750 for bigger four-bedroom homes, says Melanie Moore, Queenstown Accommodation Centre’s Wānaka manager.

Wānaka central properties and those close to Mount Aspiring College, Wānaka Primary and Holy Family schools are the most popular for renters. Property management company Home & Co director Colleen Topping says Northlake properties are increasing in popularity as the subdivision becomes established and there are fewer building works.

Three and four-bedroom homes with a garage, good heating and insulation are the most popular for families and people in a flatting situation.

Compared to Queenstown, Wānaka has a much smaller pool of rental properties and this year there is a shortage of seasonal rentals for the winter (mid-May to mid-October) despite particularly strong demand. “Permanent residents are not leaving as they usually do, for warmer climes this winter and it’s led to fewer houses available to rent for skiers and athletes training at the Snow Sports Academy,” says Moore.

However, Wānaka’s rental market has been described as “buoyant” by Topping. “Investors [are] still buying properties.”

INVESTORS STILL IN THE HUNT

Although it is difficult to find a deal for investors in Queenstown they are still looking, says Queenstown/Dunedin iFindProperty agent Dean Horo.

“Generally, investors buying are long-term holders of property and rental income is at the top of their priorities. While rents have dropped it hasn’t made it any easier to find properties that are positive income earners.”

Horo says Queenstown has always been a good place for investors to get a toe-hold. “Over the past 20 years the town has moved forward, land has been opened up for housing and prices have been going upwards until recently when a few areas dipped slightly.”

He says despite businesses closing and people losing their jobs, investors are still lining up to buy properties and it will keep continuing, although fear of missing out has been replaced by fear of paying too much. “I have been getting a lot of enquiries from investors but it is challenging to find a deal. My job is to beat the market and the market is hot.”

Many investors are interested in the multi-income properties popping up at Hanley’s Farm and to a limited extent Jack’s Point. The Queenstown Lakes District Council loosened rules around density to allow houses with attached flats to be built on small sites to overcome the extreme rental shortage and high prices pre-Covid. More are still being built.

Horo says while some of these properties are empty or renting at below market rates they will come back to normal when the borders open and by then better housing supply should meet demand.

He says he has already had investors saying they will sell existing properties and buy new builds because the Government’s plan to scrap mortgage interest deductions will not affect new homes. “The devil is [in] the definition of a new home and how long it will be regarded as new,” he says. ■

FIND OUT MORE: INVESTING IN QUEENSTOWN AND WĀNAKA

Southland Property Investors Association holds regular events and is a great source of information about the Queenstown and Wānaka markets. See southland@nzpif.org.nz for more details

Comments

No comments yet.

Sign In to add your comment