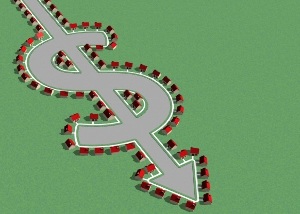

After the Reserve Bank imposed a 40% deposit requirement on investors earlier this week, more clients are expected to be turned away by their bank.

Avanti, which slashed its near-prime variable rate to 3.95% this week, believes non-bank floating rates will offer a useful solution for advisers and clients.

Avanti's head of distribution Stephen Massey said a wide range of good quality borrowers are being rejected in the current climate.

He said a wide mix of customers were seeking non-bank options.

"There's a diverse range of customers finding it difficult to get a loan. A lot of it is related to life events, but in the investor space, there are people with good banking relationships that have reached a point where their bank is not prepared to help with new transactions.

"It's clear that change is coming for investors," he said. "And our role is to support customers just outside of the banks' criteria. We're trying to support advisers with an alternative as finely priced as possible."

Some first home buyers had also found it tough, Massey said.

"Banks are uncomfortable with low deposit first home buyers. They are looking at people taking $30,000 from KiwiSaver and $10,000 from mum and dad, and want to see more 'genuine' savings," he said.

Avanti's 3.95% variable rate makes it cheaper than the big four.

While Kiwibank has slashed its floating rate to 3.4%, the big four have not budged on variable rates since the official cash rate plummeted last year.

Comments

No comments yet.

Sign In to add your comment