Pepper spices up its birthday

Non-bank lender Pepper Money is going green for its 21st birthday.

Kiwibank lockdown rate hikes

State-backed Kiwibank has followed the Australian-owned big four with lockdown rate hikes.

SBS operating surplus jumps, targets reverse mortgage growth

The SBS Group reported an operating surplus of $55.2 million for the year ending March 2021, up from $21.3 million in the previous 12 months.

HSBC fixed rates creep up

HSBC has raised its 12 month and 18 month home loans above the 2% threshold as mortgage rates begin to edge up from record lows.

Avanti slashes near-prime mortgage rate

Avanti has reduced its near-prime mortgage rate to under 4%, as non-bank lenders offer increasingly competitive loans.

Harmoney floats

Lender and former P2P specialist Harmoney has joined the stock market in Australia and New Zealand.

-

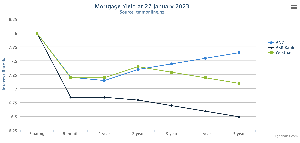

Yield curve: Jan 27

-

Pepper spices up its birthday

Non-bank lender Pepper Money is going green for its 21st birthday.

-

Kiwibank lockdown rate hikes

State-backed Kiwibank has followed the Australian-owned big four with lockdown rate hikes.

-

SBS operating surplus jumps, targets reverse mortgage growth

The SBS Group reported an operating surplus of $55.2 million for the year ending March 2021, up from $21.3 million in the previous 12 months.

-

HSBC fixed rates creep up

HSBC has raised its 12 month and 18 month home loans above the 2% threshold as mortgage rates begin to edge up from record lows.

-

Avanti slashes near-prime mortgage rate

Avanti has reduced its near-prime mortgage rate to under 4%, as non-bank lenders offer increasingly competitive loans.

-

Harmoney floats

Lender and former P2P specialist Harmoney has joined the stock market in Australia and New Zealand.

-

Pepper makes trail pledge

Pepper Money will keep paying trail to advisers with Covid-19 affected clients until the end of next year.

-

Financial Markets Authority takes ANZ to court

The Financial Markets Authority has filed court proceedings against ANZ New Zealand over issues with credit card repayment insurance policies.

-

Simplicity launches 2.5% floating rate

KiwiSaver provider Simplicity has launched a 2.5% floating rate mortgage for first home buyers, becoming the cheapest home loan in New Zealand.

-

New record low mortgage rate at 2.8%

China Construction Bank has slashed its one year mortgage rate to just 2.8%, becoming a new record low for the New Zealand market.

-

ANZ capital failings highlighted

ANZ New Zealand failed to control internal processes concerning its capital modelling systems, according to new report.

-

TSB one-year falls to 3.09%

TSB is the latest bank to slash fixed rates after the Reserve Bank's emergency OCR cut last week, cutting its one year rate to 3.09%

-

ASB matches 3.05% rate

ASB is the latest bank to slash fixed rates, matching ANZ's one year price of 3.05%.