Financial Advice NZ is leading a group meeting with the Commerce Commission over its recent report into banks.

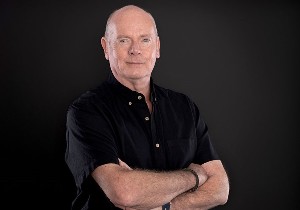

Mortgage adviser Jeff Royle is part of the group and believes it will be the right time to “tack-on” a discussion about non-disclosure by lenders and how there is a simple remedy that will benefit everybody.

He has been vocal about clawbacks and the lack of disclosure by the major banks warning clients if they pay back their adviser originated loans early they may be up for other costs.

He says advisers are making slow progress on getting a warning in bank documents and now is the time to delve into the issue at a high level.

“Non-bank lender Reismac is leading the way, talks the talk and includes in its documents a one-liner that tells clients if they repay their loan early they may be in for other costs. Since Resimac has been doing that we haven’t had one nasty situation – we have had positive outcomes.”

Royle says it is such a simple solution to make borrowers aware they may have a liability when they approach their lender for early repayment.

The BNZ has also put a line in their loan documents and is sending Royle a set of blank documents so he can assess what the wording says. “We need a standardised clause that every lender can use so there is no ambiguity.”

He supports clawbacks – repayment or part repayment of commission if a loan is repaid to the lender within 27 months of it being taken out.

“It is the non-disclosure to clients about other costs and to advisers, who often have no idea until they get their commission statement, that a loan has been repaid early. They then try to bill the client for the lost commission and all hell breaks loose. It could so easily be fixed by one line in every lender’s loan documents so everybody is aware of where they stand.”

The Commerce Commission started a furore a couple of weeks ago when releasing its draft report into banking competition by claiming mortgage “brokers” are at risk of being “unduly influenced” by the commissions that banks pay them for placing mortgages.

Royle and a raft of other advisers made scathing remarks about the commission and its chairman John Small being asleep for the past five years when major changes to the industry were made.

No date has yet been set for the meeting.